Bitcoin Marketcap

$1.29T

Gold Marketcap

$31.14T

BTC Settlement Volume (24hr)

$12.90B

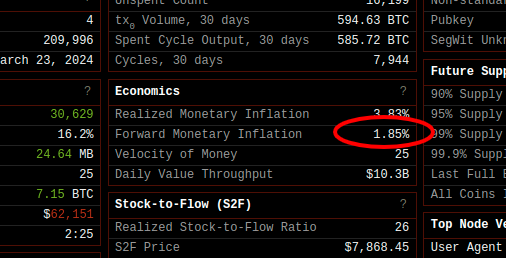

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

Bitcoin Marketcap

$1.29T

Gold Marketcap

$31.14T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

In a blog post on bitcoin and the crypto-economy overall today, Mass Mutual's Chief Investment Officer Tim Corbett explained the 170 year old firm's approach to Bitcoin and digital assets, which can be summed up as "taking the long view".

Mr Corbett explained:

Bitcoin’s unique characteristics—including digital scarcity, known supply growth, transfer characteristics, and hard cap on the total number of tokens—open the possibility that it may serve as a kind of “digital gold,” with the potential for significant price appreciation.

He also pointed out bitcoin's volatility and risk profile, but noted: "In our position as a leading mutual life insurance company, we have the ability to take that long view."

Additionally, Mr Corbett announced that Mass Mutual is launching Flourish Crypto, which he described as "a cryptocurrency investing solution built for Registered Investment Advisors (RIAs) and their clients", significantly raising the profile of bitcoin as an investment asset to the key group of investment advisors.

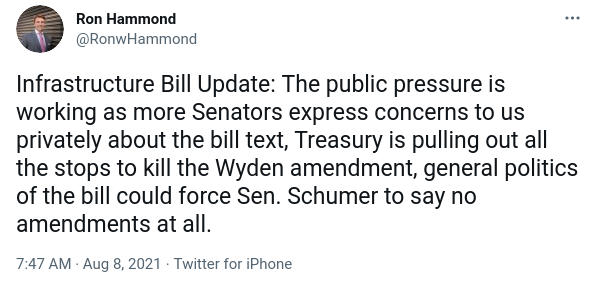

Ron Hammond, Director of Government Relations for the Blockchain Association, tweeted that the Treasury Department is "pulling out all the stops to kill the Wyden amendment". The amendment, introduced by Senators Wyden (D-OR), Lummis (R-WY), and Toomey (R-PA), fixes some of the stifling and impossible-to-comply-with language in President Biden's "must-pass" "infrastructure bill". The bill contains hastily-added language, in a misguided attempt to "pay for" a small portion of the bill's total cost by vastly expanding the definition of a cryptocurrency "broker". The new definition imposes excessive (& unworkable) surveillance requirements on many bitcoin and crypto companies and actors, including, potentially, entities such as miners and developers.

The bitcoin and crypto communtities have rallied behind the Wyden/Lummis/Toomey amendment, which explicitly exempts various entities from the new "broker" language, including miners and developers. Grassroots calls to senators nationwide have revealed meaningful influence in Washington, and contributed to the vote on the key bill being delayed several times.

An alternative amendment, offered by Senators Warner (D-VA) and Portman (R-OH) attempts to clarify the language as well but leaves large gaps in exempted entities, most notably developers. Mr Hammond and others have noted that the Treasury department is behind both the original last-minute language added to the Infrastructure bill, as well as the Warner/Portman amendment which does not sufficiently fix the language. The all-too-probable speculation is that Treasury wants to include vague and wide-reaching language in order to preserve optionality in aggressively attacking the industry through internal regulatory rule-making processes once they have legislative cover to do so. After all, bitcoin and crypto offer an alternative form of money and a new and open way to build a financial system.

Make Your Voice Heard

Anyone who cares about bitcoin and the ability to participate in the bitcoin economy in the United States should tweet (any time) or call (during business hours) their senators, encouraging them to support the Wyden/Lummis/Toomey amendment. Phone numbers and sample talking points can be found at the fightforthefuture.org.

Keep Track of Your Senators

A website keeping track of which senators have come out either for or against the bitcoin and crypto economy can be found here: didtheyvoteagainst.me.

tldr

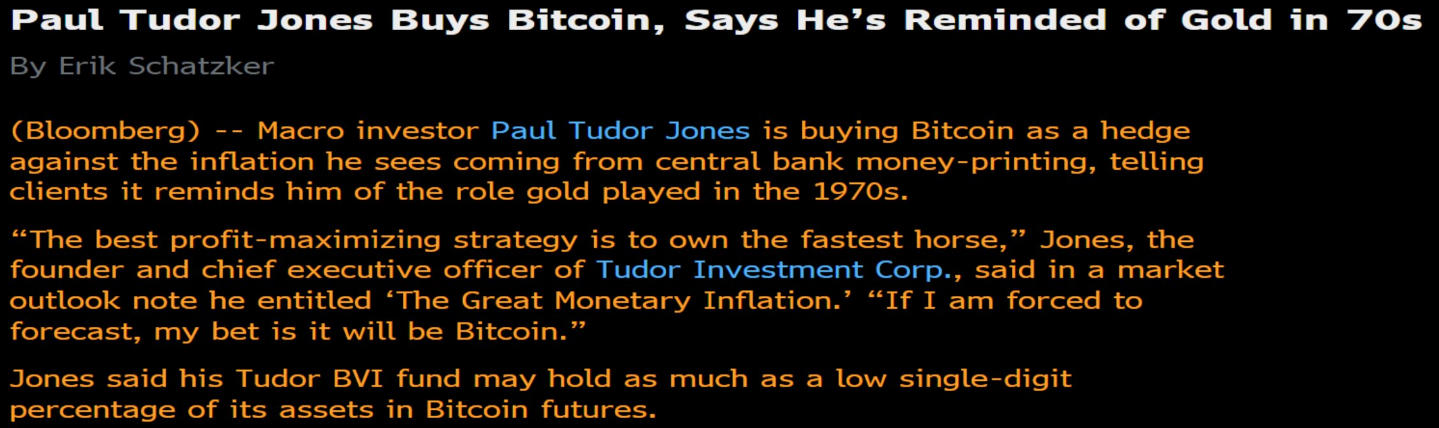

In a CNBC interview this morning, Paul Tudor Jones emphasized that he likes BTC due its certainty, stating:

I like bitcoin. Right? Bitcoin is math. And math has been around for thousands of years. And two plus two is gonna equal four and it will for the next 2000 years. So I like idea of investing in something that's reliable, consistent, honest, and 100% certain. So bitcoin has appeal to me because it's a way for me to invest in certainty.

He went on to contrast bitcoin's certainty with the Federal Reserve, and US politics:

I look at the difference between the Fed at 2013, the Fed at 2021. How can this...do I want to have to faith necessarily....I look at the difference between Trump and Biden...do I want to have faith in that same reliability of human nature?

Finally, Mr Jones suggested a 5% bitcoin position as one of the few holdings he has sufficient conviction in given uncertainty surrounding Fed policy:

I like bitcoin as a portfolio diversifier... The only thing that I know for certain is that I want to have 5% in gold, 5% in bitcoin, 5% in cash, 5% in commodities, at this point in time. I don't know what I want to do with the other 80%. I want to wait and see what the Fed's gonna do, because what they do will have a big impact.

tldr

El Salvador President, Nayib Bukele joined Nic Carter, Balaji Srinivasan, Caitlin Long, and others, for an impromptu discussion about El Salvador's bitcoin bill last night, while the bill was being voted on and ultimately passed.

The discussion is notable for many reasons, but gives a good overview of both the rationale, and various implementation details.

Specifically, the motivation includes:

- A sense of futurism: bringing new tech and approaches to El Salvador

- Remittances: cutting out middlemen (which can take up to 30%) for El Salvador's significant remittance flows

- Attracting entrepreneurs, investment, and other tech talent to the country

Implementation:

- The government will run a $150mm (initially) "trust-fund" to facilitate exchange between BTC and USD if a merchant doesn't want to take any BTC price risk

- The state will provide training and (optional) wallet software to the populace

- El Salvador will grant immediate residency to anyone who invests 3 BTC (specifically BTC-denominated) into the country

Stephan Livera summarized the conversation on twitter earlier today:

tldr

At the Bitcoin 2021 conference in Miami on Saturday, the President of El Salvador, Nayib Bukele, announced (via video) that he will introduce legislation making bitcoin legal tender in the country. The legislation is likely to pass, given Bukele's effective control of the legislature (and public popularity: ~90%), which would make El Salvador the first sovereign nation to consider bitcoin legal tender.

Legal Tender

El Salvador currently uses the US dollar as legal tender. It will continue to do so, but under the proposed legislation, El Salvador would also treat bitcoin as legal tender, giving bitcoin specific advantages in the country currently enjoyed by USD, such as default-acceptability for repayment of debts, and no capital gains taxation involving use of BTC, plus potentially a host of broader fx-related knock on effects.

Impact & Rationale

Bremmer went on to note that a move like this for El Salvador, and potentially other countries, can be a way for those countries to avoid having to institute capital controls, which would inevitably harm their middle class. He noted: "You could imagine them moving away from their existing currencies towards bitcoin. I think it's possible."

That line of thinking dovetails with a few sentences which apparently appear in the proposed legislation:

"Central banks are increasingly taking actions that may cause harm to the economic stability of El Salvador. In order to mitigate the negative impact from central banks, it becomes necessary to authorize the circulation of a digital currency with a supply that cannot be controlled by any central bank and is only altered in accord with objective and calculable criteria"

Bukele also outlined some motivation on twitter, reflecting El Salvador's large reliance on remittances and large unbanked population:

Contagion?

In the days immediately following Bukele's announcement, politicians from Paraguay, Argentina, and Brazil all expressed support for bitcoin via twitter, by changing their profile pictures to "laser eyes", a meme in the bitcoin community. While far from the steps Bukele has taken, the acknowledgement from 3 other South American politicans, however subtle, shows how the idea of bitcoin as a tool for governments can spread. Latin America in particular has suffered over the years from various currency crises; it perhaps should come as no surprise that many countries in the region show some forward thinking and early appreciation for a digital currency with credible supply dynamics that isn't controllable by any nation.

tldr

In a yet-to-be published interview for Coindesk, Bridgewater Founder and Co-CIO Ray Dalio stated both that he owns some bitcoin, and that he'd "personally rather have bitcoin than a bond".

tldr

Legendary macro investor, Stanley Druckenmiller, followed up a WSJ opinion piece titled "The Fed is Playing with Fire" with a CNBC interview in which he lays out the ramifications for the dollar given the Fed's QE persistence. He said that the dollar is "more likely than not" to lose its reserve currency status in the next 15 years, and calls out "crypto" as the replacement (note that Druckenmiller holds bitcoin)

Regarding "crypto", he said:

5 or 6 years ago, I said that crypto was a solution in search of a problem. And that's why I didn't play crypto the first wave. We already had the dollar, what did we need crypto for? Well the problem has been clearly identified. It's Jerome Powell and the rest of the world's central bankers. There's a lack of trust. So sort of groping for an answer, for a central case, a best guess; and it's hard to make a forecast 3 months from now, much less 15 years from now, I think the most likely replacement would be some kind of ledger system invented by some kids from MIT or Stanford or some other engineering school, that hasn't even happened yet, that can replace the dollar world wide. I don't know what that will be. I just know that if the Fed is forced to monetize the debt...

Druckenmiller went on to describe the Fed's current ongoing policy as 'radical':

[This is] certainly the most radical policy by a longshot that I've ever seen relative to the economic circumstances. ... I can't find any period in history where monetary and fiscal policy were this out of step with the economic circumstances. Not one.

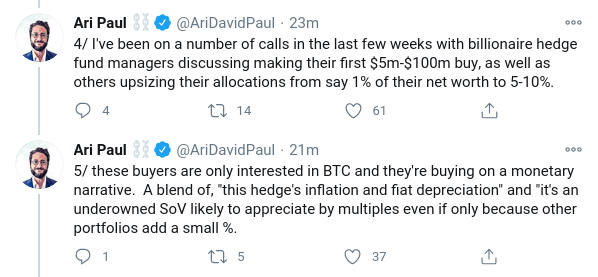

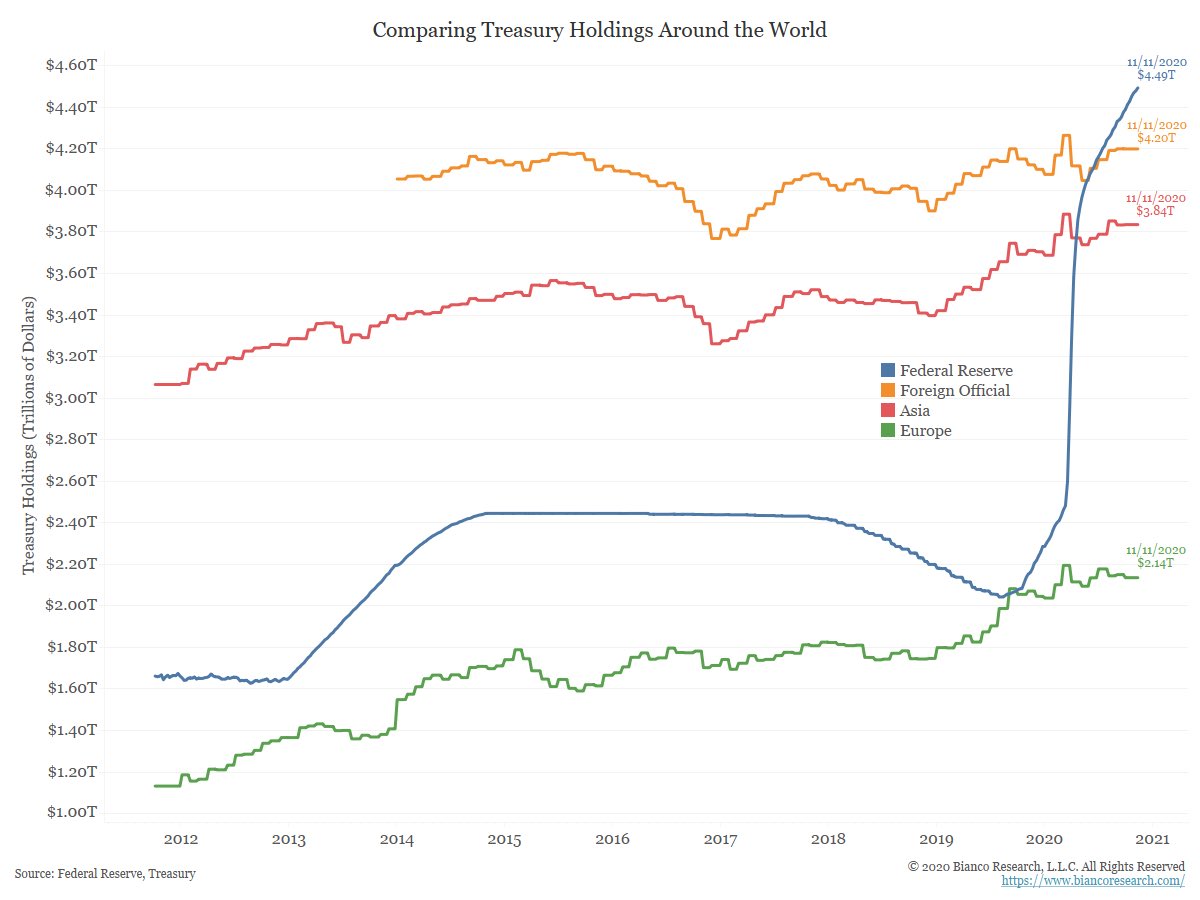

And further, Druckenmiller outlined how the Fed is monetizing Congress' spending, how flows (specifically foreigners selling USTs) are putting pressure on bonds, and how the Fed is being forced to monetize the debt, which he thinks will trigger loss of USD as global reserve within the next 15 years:

You said that to some extent the Fed is enabling the fiscal transfers. It's not to some extent, they couldn't be doing this without the Fed. The Fed is monetizing their activity. I mentioned all the QE after vaccine confirmation and retail sales...we've had 850B of direct transfers. 575B of them came *after* retail sales were above trend. ... I'm old enough to remember the bond market vigilantes; I used to be one of them. Without the Fed buying I don't know what the exact number, I think it's 60% of all the debt issued, the bond markets would be totally rejecting this. So they are enabling this massive expansion in fiscal policy, and the problem is, if you end up getting inflation, and frankly, even if you don't, the debt is gonna be so big...we just put $6T of new debt on. Again, all enabled by the Fed. These guys could not be doing it, bond rates would go to a prohibitive level. My issue here is, in the future, as we go forward... They're [the CBO] saying, if 10-years [USTs] go to 4.9%, which is their normalized projection, the interest expense alone will be 30% of GDP every year. That's basically what we just spent on the covid emergency in the last year. There is no way we can afford to have 30% of all government outlays be towards interest expense, so what will happen is that the Fed will have to monetize that. When they monetize it, I believe it'll have horrible implications of the dollar. And that's why I said in that speech, yes, that I think it's more likely than not within 15yrs we lose reserve currency status...

tldr

CNBC is reporting that NYDIG has partnered with hundreds of banks in the US to provide customers with bitcoin buy/sell/hold services from within their existing bank accounts. CNBC elaborates:

Hundreds of banks are already enrolled in the program, according to Patrick Sells, head of bank solutions at NYDIG. While the firm is in discussions with some of the biggest U.S. banks, many of the lenders that have agreed to participate are smaller institutions like Suncrest, a California-based community bank with seven branches.

This comes on the heels of major investment banks such as Goldman Sachs, JP Morgan, and Morgan Stanley announcing bitcoin-investment services for wealthy clients. This move by NYDIG will expand convenient access to bitcoin far beyond that clientele.

CNBC also notes that banks can no longer ignore demand for bitcoin:

But banks are now asking for bitcoin because they can see their customers sending dollars to Coinbase and other crypto exchanges, according to Yan Zhao, president of NYDIG. “This is not just the banks thinking that their clients want bitcoin, they’re saying `We need to do this, because we see the data,’” Zhao said. “They’re seeing deposits going to the Coinbases and Galaxies and Krakens of the world.”

tldr

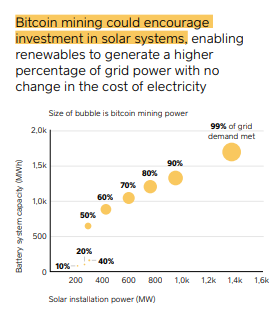

Square Crypto and ARK Invest released a report last week evaluating the potential for bitcoin mining to spur deployment of solar and other renewables across the global energy grid. The analysis suggests that bitcoin mining can have a substantial net-positive environmental impact:

The key observation is that solar and wind are intermittent power sources, and therefore more difficult to profitably deploy at utility scale, since energy generation must always be matched with energy demand at that moment. But bitcoin mining can act as an 'energy buyer of last resort', allowing utilities to 'over build' solar and wind, and simply channel that energy into bitcoin mining when the rest of the grid is not demanding it. See the report for further detail.

tldr

CoinDesk is reporting that JPMorgan is planning on rolling out an actively-managed 'bitcoin fund' to its private wealth clients.

JPMorgan CEO Jamie Dimon has made many headlines in the past for aggressively disparaging bitcoin, even calling it a "fraud" in 2017. It seems client demand plus keeping up with competitor offerings - such as Morgan Stanley's and Goldman Sachs' new bitcoin initiatives - has proven the greater force than Mr. Dimon's personal opinions.

tldr

The US State of Louisiana passed a resolution yesterday "To commend Bitcoin for its success in becoming the first decentralized trillion dollar asset and to encourage the state and local governments to consider ways that could help them benefit from the increased use of this new technology."

The resolution focuses on bitcoin, but makes one reference to a local 'community currency', which may be part of the legislature's underlying motivation. In any event, the resolution goes on to reference various aspects of bitcoin's design, its relationship to gold, and even specifically commends Satoshi Nakamoto:

WHEREAS, Bitcoin, which could potentially replace gold as a monetary reserve, is limited and finite and there is a maximum capacity of only twenty-one million bitcoins allowed to be produced; ... WHEREAS, not only has Bitcoin proven to be a critical tool for businesses, it has proven to be a critical tool for citizens around the world to protect themselves from currency debasement. THEREFORE, BE IT RESOLVED that the House of Representatives of the Legislature of Louisiana does hereby commend Satoshi Nakamoto for his contribution to economic security. BE IT FURTHER RESOLVED that the House of Representatives of the Legislature of Louisiana does hereby commend Bitcoin for its success in becoming the first decentralized trillion dollar asset and encourage the state and local governments to consider ways that could help them benefit from the increased use of this new technology.

tldr

On Saturday night, the price of bitcoin (on Coinbase) dropped from over $60,000 at 8pm EDT to a brief low of $51,300 less than 3hrs later. Price has since recovered to ~$56,300 as of this Monday morning. So what happened?

Traders were using excessive leverage to go long. Funding rates for borrowing on Binance and other exchanges were in excess of 100% annualized. This is nothing new (rates were as high or higher near the Jan 8th $42k peak, as well as the February $58k peak), but it set the stage for a leverage cascade should something trigger even a moderate sell off. As it turns out, there were 3 triggers. All of them containing substantial degrees of misinformation, but with so many traders on margin, time to get at the truth was minimal.

Trigger #1: misinterpreted insider sales of Coinbase equity ($COIN).

There was a table circulating on twitter showing how much $COIN various C-level execs at Coinbase sold. The table misinterpreted how much equity each person actually owned, presumably by looking only at fully vested shares (ie, not accounting for additional options grants and unexecuted options), and therefore concluded that executives sold the majority of their shares, which people interpreted as bearish for the industry. Frank Chaparro at The Block cleared this up, finding that execs sold a far smaller portion of their shares:

Trigger #2: questionable 'news' about the Treasury Dept charging cryptocurrency businesses.

At 10:42pm on Saturday, a twitter account with a significant following tweeted: "U.S. TREASURY TO CHARGE SEVERAL FINANCIAL INSTITUTIONS FOR MONEY LAUNDERING USING CRYPTOCURRENCIES -SOURCES", with no further information available anywhere. Apparently some traders took this as reliable news; the majority of the downward price action took place minutes after this tweet. A couple hours later, Jake Chervinsky, General Counsel at Compound Finance, noted that this 'news' did not seem credible:

Trigger #3: Small-Sample Hashrate Data.

There have been power outages in Xinjiang Provence, China, the past few days, where a non-trivial portion of the bitcoin network's hashpower is located. Naturually, this caused a drop in hashrate, but measuring exactly how much is difficult due to the fact that bitcoin mining is a statistical process; thus hashrate data & charts are necessarily estimates. Data from CoinMetrics.io shows that these estimates fell from a high of 198 Exahash/s on April 15th, to 106 Exahash/s on Saturday (April 17th), a roughly 46% drop. But the estimate for yesterday (April 18th) has rebounded to 145 Exahash/s. It's reasonable to expect a significant change in hashrate due to the power outage (& we see significant variation when miners move equipment in China just due to seasonality), but it's unreasonable to assess these numbers on a 24hr basis due to the inherant statistical variance. Smoothed data over a week or so are far more representative. Nic Carter summed it up best:

tldr

Former CIA Acting Director, Michael Morell, authored a report recently that looked into Bitcoin's use in illicit finance. In short, he found that illicit use of Bitcoin is far less than many people assume, and probably even a significantly smaller share of the bitcoin-economy than illicit use of dollars are vs global GDP.

The report states:

Based on our research and discussions with industry experts, I have confidence in two conclusions: • The broad generalizations about the use of Bitcoin in illicit finance are significantly overstated. • The blockchain ledger on which Bitcoin transactions are recorded is an underutilized forensic tool that can be used more widely by law enforcement and the intelligence community to identify and disrupt illicit activities. Put simply, blockchain analysis is a highly effective crime fighting and intelligence gathering tool.

and:According to a recent study by blockchain analytics firm Chainalysis, illicit activity among all cryptocurrencies as a percent of total cryptocurrency activity from 2017 to 2020 was less than 1 percent. For Bitcoin specifically, blockchain analytics firm CipherTrace estimates that illicit activity makes up less than 0.5 percent of total transaction volume. ... All of this together suggests a broader point—that the illicit use of cryptocurrencies in general and Bitcoin in particular, as a share of total market activity, is certainly not higher than it is in the traditional banking system and is most likely less. The project was sponsored by a group of leading cryptocurrency innovators and investors. The terms of the engagement were that I would “call it as I see it,” with objectivity and transparency, just as I had done throughout my career as an intelligence analyst.

Mr Morell notes in the report that: "The project was sponsored by a group [link] of leading cryptocurrency innovators and investors. The terms of the engagement were that I would “call it as I see it,” with objectivity and transparency, just as I had done throughout my career as an intelligence analyst.", and further lists an extensive set of sources from a diverse and high-level group of both industry experts, and senior experts in government, regulatory bodies, and the intelligence community.

tldr

In a CNBC appearance this morning, US House Minority Leader Kevin McCarthy positioned Bitcoin and digital currencies as geo-politically important, especially with respect to China.

CNBC anchor Joe Kernen noted that Congressman McCarthy came on CNBC in 2019 with a "very positive" view of bitcoin, and then asked: "Do you think [Secretary Yellen and Fed Chair Powell] have a good understanding of digital currencies or bitcoin at this point?", to which the Congressman replied:

Well, I think I was right then, and I'm right now. I think they tried to ignore it to make it go away. Jamie Dimon will tell you that from the beginning he was wrong. This is moving towards the future. They should not ignore it. They should not only learn more about it, but the basis is gonna continue to grow. And this is something that those who regulate, those who are in government that make policy, better start understanding what it means for the future because other countries are moving forward, especially China. I do not want America to fall behind. I want the next century to be ours. That's why I want to look forward, not backwards, and not keep my head in the sand.

tldr

In an SEC filing dated today, MicroStrategy noted that: "Going forward, non-employee directors will receive all fees for their service on the Company’s Board in bitcoin instead of cash."

The filing elaborates on both the reasoning behind this decision, as well as the implementation:

In approving bitcoin as a form of compensation for Board service, the Board cited its commitment to bitcoin given its ability to serve as a store of value, supported by a robust and public open-source architecture, untethered to sovereign monetary policy. Under this modified arrangement, the amount of Board fees payable to non-employee directors remains unchanged and will be nominally denominated in USD. At the time of payment, the fees will be converted from USD into bitcoin by the payment processor and then deposited into the digital wallet of the applicable non-employee director.

tldr

Grayscale Investments - the manager of the Bitcoin Investment Trust, which trades as GBTC on US markets - today announced their intention to ultimately turn GBTC into a proper Bitcoin ETF.

They said:

Today, we remain committed to converting GBTC into an ETF although the timing will be driven by the regulatory environment. When GBTC converts to an ETF, shareholders of publicly-traded GBTC shares will not need to take action and the management fee will be reduced accordingly.

The GBTC product in its current form is not a traditional ETF. It is a closed-end fund with no redemption mechanism for the underlying BTC; thus fluid two-sided arbitrage cannot be done. This has caused GBTC to trade at a significant premium (at times in excess of 100%) to spot BTC throughout most of its life. In recent weeks, though, the premium has gone negative as GBTC both faces more competition as a publicly-listed instrument for BTC exposure (see $MSTR, $BTCC), and big-pocket firms participating in a carry-trade of sorts to bring the premium down.

Grayscale's statement of intent to covert to an ETF when the "regulatory environment" is right is not surprising; given that the underlying Trust and GBTC product, as currently formed, may lose competitive advantage if and when the SEC (finally) approves proper Bitcoin ETF products.

tldr

In an SEC filing dated yesterday from the "Morgan Stanley Institutional Fund, Inc", the investment bank filed for the ability to add Bitcoin exposure to 12 different funds. The filing notes that exposure can be via cash settled futures (ie, CME), or Grayscale's GBTC instrument.

Additionally, the filing states that the funds may invest up to 25% of assets into these bitcoin instruments.

tldr

CNBC is reporting that Goldman Sachs is "close" to offering bitcoin and other digital asset services to its wealth management clients.

Mary Rich - recently named global head of digital assets for the bank's private wealth management group, suggested that Goldman plans to offer investment options for Bitcoin and digital assets sometime in Q2 2021.

Rich elaborated:

We are working closely with teams across the firm to explore ways to offer thoughtful and appropriate access to the ecosystem for private wealth clients, and that is something we expect to offer in the near-term. There’s a contingent of clients who are looking to this asset as a hedge against inflation, and the macro backdrop over the past year has certainly played into that... There are also a large contingent of clients who feel like we’re sitting at the dawn of a new Internet in some ways and are looking for ways to participate in this space. We’re still in the very nascent stages of this ecosystem; no one knows exactly how it will evolve or what shape it will be. But I think it’s fairly safe to expect it will be part of our future

tldr

Argo Blockchain (listed on the London stock exchange under $ARB) today announced the formation of a bitcoin mining pool powered exclusively by clean energy.

From the press release:

Terra Pool represents the first ever opportunity for the creation of 'green bitcoin'. The initiative aims to expedite the shift from conventional power to clean energy and reduce the impact of Bitcoin mining on the environment. The mining pool will provide a platform for cryptocurrency miners to produce Bitcoin and other cryptocurrencies in a sustainable way. Peter Wall, Chief Executive of Argo Blockchain, said: "Addressing climate change is a priority for Argo and partnering with DMG to create the first 'green' Bitcoin mining pool is an important step towards protecting our planet now and for generations to come. We are hopeful other companies within the Bitcoin mining industry follow in our footsteps to demonstrate broader climate consciousness."

Bitcoin has been under fire of late due to concerns over it energy use and climate impact. These concerns are mostly misplaced, due a variety of reasons. Argo Blockchain's creation of a clean-energy-only mining pool is a demonstration of the incentives at play; specifically that bitcoin mining is profitable on clean-energy, and the incentives for ever greater share of total mining to be powered by clean energy sources is only likely to increase in the future.

Jack Dorsey, CEO of Twitter and Square, even suggested recently that Bitcoin may be ~100% powered by clean energy in the future:

“We believe that cryptocurrency will eventually be powered completely by clean power, eliminating its carbon footprint and driving adoption of renewables globally... Published estimates indicate bitcoin already consumes a significant amount of clean energy, and we hope that Square’s investment initiative will accelerate this conversion to renewable energy.”

For more discussion of bitcoin's energy use, and references to further reading on the topic, see our Common Bitcoin Critique #4 page.

tldr

In an interview with Bloomberg published today, Dawn Fitzpatrick, CIO of Soros Fund Management (AUM: $5.295B), both made the case for bitcoin, as well at hinted as owning some (either personally, or for the fund):

When asked directly "Do you own any bitcoin?", she paused for several seconds, laughed, and answered: "I'm not gonna answer that."

Here's a transcript of the above segment:

[Fitzpatrick] When it comes to crypto generally, we're at a really important moment in time, in that, something like bitcoin might've stayed a fringe asset, but for the fact, over the last 12 months, we've increased money supply in the US by over 25%. So there's a real fear of debasing of fiat currencies. And when you think about bitcoin, I don't think it's a currency, I think it's a commodity, but it's a commodity that's easily store-able, it's easily transferable, the IRS classifies it as a physical asset, it has a finite amount of supply, and that supply halves every 4 years. So I think it's interesting. And I think by the way, when you look at gold price action, in the context of a fairly robust inflation narrative of late, it's struggled getting traction and I think that's because bitcoin is taking some of its buyer base away. [Bloomberg]: Do you own any bitcoin? [Fitzpatrick] {pause} {laughs} I'm not gonna answer that. [Bloomberg] That is what I would call a mysterious response. [Fitzpatrick] But I will say, the one thing also, when you think about bitcoin... Central bank digital currencies are going to be here, I think quicker than people expect. China's been running their trial for a while now, and I think there are some strategic reasons why they're going to be a first mover. And I do think, from a geo-political perspective, they want that digital currency to be used around the world and it is a potential threat to bitcoin and other cryptocurrencies. [Bloomberg] I was just going to say, does that legitimize bitcoin, or does that delegitimize bitcoin? [Fitzpatrick] So I think it is a real threat, but I think it will be temporary. I don't think they'll be successful in permanently destabilizing bitcoin.

tldr

As of today, Microsoft has deployed v1 of the "ION" decentralized identity platform that the company spear-headed, on top of the Bitcoin network. At root ION provides "decentralized identifiers" - things like usernames, email addresses, or anything online that can be pointed to - in a way that doesn't rely on any third party, including Microsoft. ION accomplishes this by fundamentally anchoring the system to the Bitcoin blockchain, due to Bitcoin's unmatched neutrality and decentralization assurances.

Microsoft's release announcement explains:

We are excited to share that v1 of ION is complete and has been launched on Bitcoin mainnet. We have deployed an ION node to our production infrastructure and are working together with other companies and organizations to do so as well. ION does not rely on centralized entities, trusted validators, or special protocol tokens – ION answers to no one but you, the community. Because ION is an open, permissionless system, anyone can run an ION node, in fact the more nodes in operation, the stronger the network becomes

According to the release, ION has been in development for 4 years, with the first pre-release mention of it running on top of bitcoin occurring in 2019.

tldr

Fidelity (AUM $4.9T) has filed with the SEC to manage a Bitcoin ETF, under the name "Wise Origin Bitcoin Trust". This is one of many recent filings, but as a heavyweight in the traditional asset management industry, Fidelity's entry puts more pressure on the SEC to finally approve a Bitcoin ETF (after 5+ years of reviewing & rejecting various applications).

tldr

Tesla CEO Elon Musk tweeted overnight that Tesla is now accepting bitcoin for car purchases, and that they will hold any received BTC instead of converting it to fiat (dollars).

Musk further noted that Tesla is using open-source BTC payment software to handle the payments, as well as running their own Bitcoin nodes directly - ie, instances of the software that form the core fabric of the globally distributed bitcoin network.

tldr

US Federal Reserve Chairman Jerome Powell spoke at an event held by the Bank of International Settlements today. He offered some brief thoughts on bitcoin and crypto-assets generally:

cryptoassets - they're highly volatile - see bitcoin - and therefore not really useful as a store of value, and they're not backed by anything. They're more of an asset for speculation. So they're also not particularly in use as a means of payment; it's more a speculative asset that's essentially a substitute for gold rather than for the dollar. And I think with cryptoassets, the public needs to understand the risks. The principle thing is, there's the volatility, there's also the outsized energy requirements for mining, and the fact that they're not backed by anything.

Chairman Powell's remarks echo previous statements made in 2019 where he described bitcoin as a gold-like "speculative store of value".

tldr

CNBC is reporting that Morgan Stanley - one of the US's largest banks - will soon provide its wealthy clients (at least $2mm on deposit) access to 3 bitcoin funds: two from Galaxy Digital, and one from NYDIG.

CNBC calls the move 'a significant step for the acceptance of bitcoin as an asset class', explaining:

...clients demanded exposure to the cryptocurrency, said the people, who declined to be identified sharing details about the bank’s internal communications. Bitcoin’s rally in the past year has put Wall Street firms under pressure to consider getting involved in the nascent asset class.

tldr

In a piece titled "Why in the World Would You Own Bonds When...", Bridgewater (AUM: $150B) Founder and Co-CIO Ray Dalio outlines why he believes the world (and the US in particular) is in the final states of a long-term debt cycle, why that means bonds and cash are "trash", and how to think about positioning for what's to come. He notes: "The economics of investing in bonds (and most financial assets) has become stupid", and goes on to say:

The world is a) substantially overweighted in bonds (and other financial assets, especially US bonds) at the same time that b) governments (especially the US) are producing enormous amounts more debt and bonds and other debt assets. This is particularly true for US bonds.

Further, Dalio notes that there are over $75trillion in "US debt assets of varying maturities", and outlines how a "run on the bank" - an unstoppable wave of bond selling - can start, and what governments ultimately have to be do about it:

History and logic show that central banks, when faced with the supply/demand imbalance situation that would lead interest rates to rise to more than is desirable in light of economic circumstances, will print the money to buy bonds and create “yield curve controls” to put a cap on bond yields and will devalue cash. That makes cash terrible to own and great to borrow.

Dalio ends the article with a note on how policy makers may try and stem the flow out of bonds and into hard assets, and how the optimal portfolio for these times is no longer the traditional 'stock/bond mix':

If history and logic are to be a guide, policy makers who are short of money will raise taxes and won’t like these capital movements out of debt assets and into other storehold of wealth assets and other tax domains so they could very well impose prohibitions against capital movements to other assets (e.g., gold, Bitcoin, etc.) and other locations. These tax changes could be more shocking than expected.

I think this is the new paradigm.

For these reasons I believe a well-diversified portfolio of non-debt and non-dollar assets along with a short cash position is preferable to a traditional stock/bond mix that is heavily skewed to US dollars. I also believe that assets in the mature developed reserve currency countries will underperform the Asian (including Chinese) emerging countries’ markets. I also believe that one should be mindful of tax changes and the possibility of capital controls.

tldr

Norwegian energy company, Aker ASA, has formed a new subsidiary dedicated to bitcoin. The subsidiary, Seetee, will hold all their liquid assets in BTC (currently ~$58mm worth), and will invest & participate in the Bitcoin ecosystem.

Seetee plans to spin up bitcoin-mining operations - a natural fit for the energy giant - but, also intends to develop bitcoin-related software, potentially based on Blockstream's products, and/or the Lightning network.

Aker's billionaire Chairman, Kjell Inge Røkke, explained:

We aim to increase [the capitalization] significantly over time as we gain experience and identify exciting opportunities ... I'm fascinated by the prospect of bitcoin Lightning wallets that may enable instant credit via micropayments without the need to offer personal information that my counterpart can monetise without approval or compensation

Additionally, Mr. Røkke published a shareholder letter which outlines both the motivation and thought process around Seetee's & Aker's committment to Bitcoin, as well as the products and services they may develop.

tldr

MicroStrategy CEO Michael Saylor tweeted this morning that the company has purchased an additional 205 BTC at an average price of $48,888/BTC.

This marks the 4th incremental BTC purchase that MicroStrategy has made, presumably with free-cash-flow generated by their underlying business.

tldr

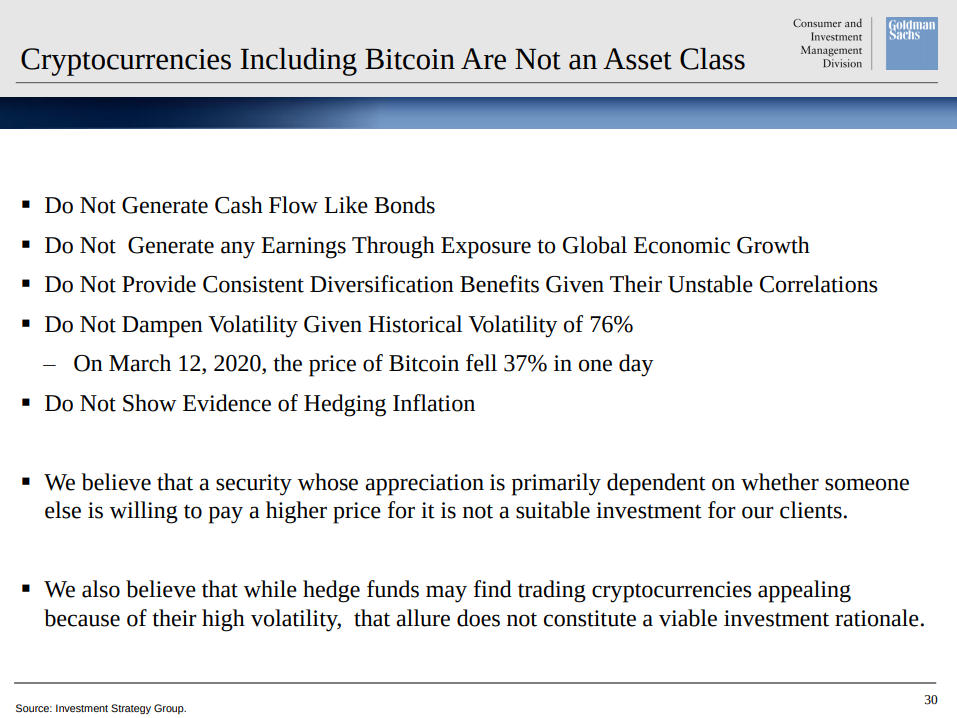

Fidelity, Citi, and Goldman Sachs all made bitcoin headlines today, with Fidelity and Citi releasing extensive (and positive) reports on bitcoin, and Goldman Sachs announcing the restart of their bitcoin trading desk.

Fidelity's Director of Global Macro, Jurrien Timmer, tweeted that bitcoin "could be treated as a form of digital gold…a possible counterweight to future monetary inflation:"

Mr Timmer also linked to a paper of his hosted on Fidelity Institutional, which suggests that bitcoin may be an appropriate replacement for some part "of the bond side of a 60/40 portfolio."

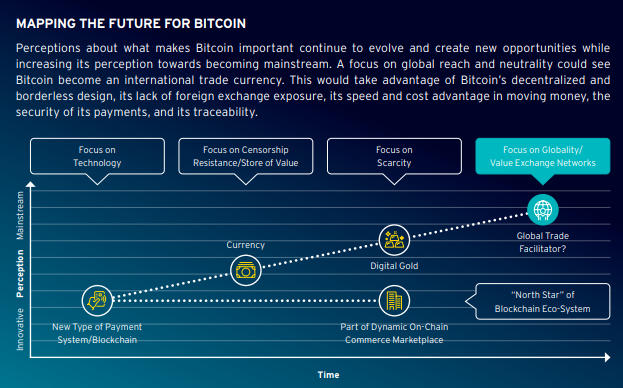

Next, Citi GPS released a 108 page report titled "Bitcoin At the Tipping Point". The report's intro notes:

In a search for yield and alternative assets, investors are drawn to Bitcoin's inflation hedging properties and it is recognized as a source of 'digital gold' due to its finite supply. ... Where could Bitcoin be in another seven or so years? The report notes the advantage of Bitcoin in global payments, including its decentralized design, lack of foreign exchange exposure, fast (and potentially cheaper) money movements, secure payment channels, and traceability. These attributes combined with Bitcoin's global reach and neutrality could spur it to become the currency of choice for international trade.

Finally, Reuters is reporting that Goldman Sachs has restarted their cryptocurrency trading desk, beginning with various bitcoin instruments. Reuters notes the bank is also exploring related bitcoin services:

the bank is also exploring the potential for a bitcoin exchange traded fund and has issued a request for information to explore digital asset custody, the source said.

tldr

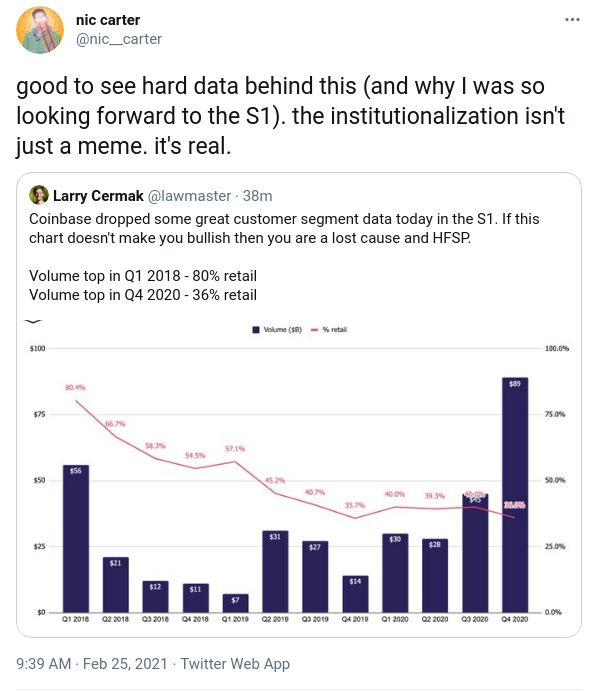

Coinbase released their much-anticipated public S1 today, clearing the way for them to list their stock on public US equity markets, likely in a matter of weeks. Coinbase's listing on public markets is considered a watershed moment for bitcoin and crypto overall. It will likely open in excess of $100B market-cap, based on recent pre-IPO-contract trading figures. Some key insights from the S1 document include Coinbase's "Assets on Platform" figure of $90B, and total verified users figure of 43mm. Note that these figures do not include any 2021 data (during which they likely experienced significant growth). Two twitter threads diving further into the numbers are here and here.

One noteworthy stat from the document highlights the institutionally-driven nature of the current bitcoin rally vs the 2017/18 cycle:

tldr

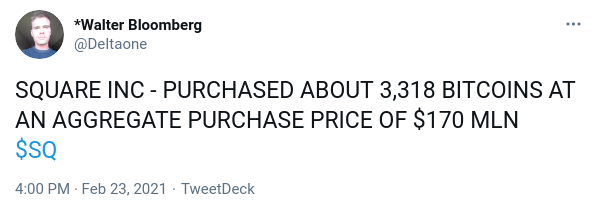

Bloomberg is reporting that Square has purchased another 3,318 BTC for $170mm. This works out to an average price of $51,235 per BTC.

tldr

BlackRock's ($8.6T AUM) Rick Rieder - CIO of Global Fixed Income and Head of the Global Allocation Team, said on CNBC this morning that BlackRock has "started to dabble a bit into" bitcoin.

Mr Rieder specifically noted the search for viable "storehouses of value" as the backdrop for this:

Today the volatility of it is extraordinary, but listen... People are looking for storehouses of value. People are looking for places that could appreciate under the assumption that inflation moves higher and debts are building, so we've started to dabble a bit into it. ... My sense is the technology has evolved, and the regulation has evolved, to the point where a number of people find that it should be part of the portfolio, so that's what's driving the price up.

When pressed regarding what % allocation BlackRock has made to bitcoin or crypto in general, he declined to give specifics but elaborated on their reasoning by saying:

We're holding a lot more cash than we've held historically because duration doesn't work, interest rates don't work as hedge, so diversifying into other assets makes some sense. And so holding some portion of what you hold in cash in things like crypto seems to make some sense to me.

tldr

UPDATE 2: MicroStrategy has completed this purchase. Final tally: An additional 19,452 BTC was purchased for a total of $1.026 billion. Average purchase price was $52,765 per BTC.

MicroStrategy now holds 90,531 BTC, worth ~$4.43 billion as of this writing.

UPDATE: MicroStrategy has upsized this offering to $900mm, with a $150mm potential add-on, and announced that the notes will bear 0% interest. MicroStrategy expects the offering to close by Friday (Feb 19th)

Original Story:

MicroStrategy announced a proposed new debt offering of $600mm, with possible $90mm add-on. The announcement states: "MicroStrategy intends to use the net proceeds from the sale of the notes to acquire additional bitcoins." The notes are convertible to cash or $MSTR stock on or after February 20, 2024 and mature on February 15, 2027.

This is the second debt offering MicroStrategy has issued, with the first occurring in December 2020, with an initial size of $400mm before being upsized to $650mm at final tally.

These debt offerings are in addition to MicroStrategy's conversion of their corporate treasury to mostly BTC, and ongoing smaller conversion of operating cash flow to BTC as part of their treasury reserve policy.

tldr

Bloomberg is reporting that: "A $150 billion Morgan Stanley investing arm [Counterpoint Global] known for its prowess in picking growth stocks is considering adding Bitcoin to its list of possible bets."

The story highlights pressure from clients, and competitive pressure vs other firms, as recent impetus for managers to add bitcoin to their investment universe:

Even institutional investors, barred by the rules of their funds from holding Bitcoin directly, have turned to such trusts. For Wall Street firms, an inability to offer Bitcoin to those clients raises the risk of losing them to other managers. That may spark fresh discussions in the industry about opening up to the asset.

tldr

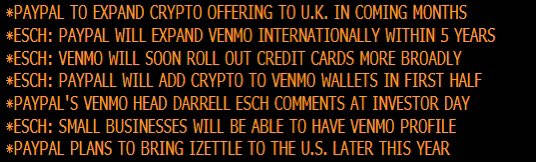

Carl Quintanilla tweeted a Bloomberg Terminal screenshot indicating PayPal's plans to expand their crypto offerings to the UK "in coming months", as well as to their popular Venmo platform in the "first half" of this year:

tldr

The Wall Street Journal is reporting that Bank of New York Mellon Corp said today that that it will: "hold, transfer and issue bitcoin and other cryptocurrencies on behalf of its asset-management clients"

WSJ continued:

In time, BNY Mellon will allow those digital assets to pass through the same plumbing used by managers’ other, more traditional holdings—from Treasurys to technology stocks—using a platform that is now in prototype. The bank is already discussing plans with clients to bring their digital currencies into the fold.

BNY Mellon's predecessor entity was founded in 1784.

tldr

Grayscale CEO Michael Sonnenshein appeared on CNBC's Squawk Box this morning to discuss bitcoin demand from corporate treasuries and institutions. Towards the end of the segment, Mr. Sonnenshein gave some insight into the demand they are seeing at Grayscale, relative to the demand spike that was seen in late 2020:

If flows are any indication of investor interest, on the heels of a record breaking 2020, very pleased to say and encouraged that momentum is not only continuing this year but is actually accelerating. So we're seeing very very sustained and growing demand, from a lot of institutional players at the moment.

tldr

In an SEC filing released today, Tesla disclosed that it has purchased $1.5 billion worth of Bitcoin, and further discussed plans to accept BTC as a form of payment for Tesla products.

The document states:

In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity. As part of the policy, which was duly approved by the Audit Committee of our Board of Directors, we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy and may acquire and hold digital assets from time to time or long-term. Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt.

tldr

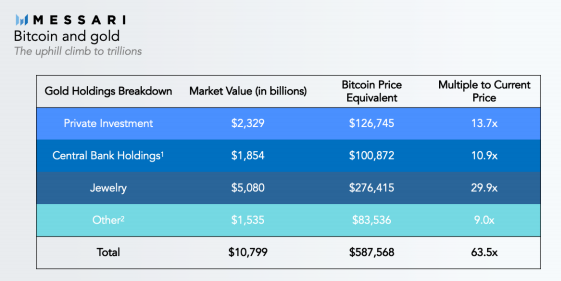

Guggenheim Partners ($270B AUM) CIO Scott Minerd updated his potential fundamental valuation target for BTC to "$400,000 to $600,000" yesterday in a CNN interview.

He said:

My view is, we did a lot of fundamental research, and if you consider the supply of bitcoin relative to the supply of gold in the world, and what the total value of gold is, if bitcoin were to go to those kinds of numbers, you’d be talking about $400,000 to $600,000 per bitcoin. Now, I'm not saying we'll ultimately get there, but that's an indication what might be a measure of fair value. That you gives you a lot of room to run.

Mr Minerd went on to strike a more balanced tone, suggesting bitcoin's recent run to just shy of $42,000 could be a speculative bubble which could retrace 50% from those highs. He elaborated:

But then when you consider that over the course of a month, we went from $20,000 to $40,000 on bitcoin, that smacks of short-term speculation. ... So you know bitcoin has had a lot of times where it's had setbacks of 50% form it's highs, I wouldn't be surprised to see that happen again.

However, he ended his comments on bitcoin with a decidedly positive long-term outlook, saying:

But I do want to say one thing, your comment about Elon Musk before we got started, Elon is definitely proven himself to be a visionary, and I think that crypto currency has come into the realm of respectability and will continue to become more and important in the global economy.

tldr

Visa announced a suite of APIs (application programming interfaces) that banks can use to offer bitcoin-related services, including buying and selling bitcoin, and related visa-card services.

Visa's crypto lead, Cuy Sheffield, explained to CoinDesk:

This is shifting to the next phase of Visa’s strategy where we’re looking at how Visa can also be a bridge between the thousands of financial institutions … and help them tap into the growing world of crypto assets and blockchain networks. We’re excited to see what early tests and consumer engagement look like for things like dollar-cost averaging to buy bitcoin or for things like earning bitcoin back as rewards.

Visa is using institutional crypto-services firm Anchorage to underpin its offerings. Anchorage made headlines just last month for becoming the first OCC-approved national crypto bank.

tldr

MicroStrategy CEO Michael Saylor tweeted this morning that the company purchased an additional ~295 BTC for $10mm (at an avg price of ~$33,808).

This is the 2nd $10mm follow-on to MicroStrategy's original conversion of the majority of their treasury to BTC.

tldr

Tesla and SpaceX CEO Elon Musk changed his twitter bio overnight to simply: #bitcoin:

This coincided with a substantial rally in bitcoin's price:

tldr

Bridgewater Associates released a 14-page report [UPDATE: see it here] on Bitcoin as part of their daily newsletter (shared with CaseBitcoin), including comments from founder Ray Dalio. Dalio takes care to note his relative ignorance on bitcoin, but overall, his tone is one of appreciating bitcoin's fundamentals, yet remaining very cognizant of certain risks.

Mr. Dalio says "Bitcoin is one hell of an invention", and in further appreciation of bitcoin's core value proposition, he notes:

Because of what is going on in the world, besides there being a growing need for money or storehold of wealth assets that are limited in supply, there is also a growing need for assets that can be privately held.

But his overall tone is balanced. He highlights two specific risks which give him pause:

Although Bitcoin is limited in supply, digital currencies are not limited in supply because new ones have come along and will continue to come along to compete so the supply of Bitcoin like assets should, and competition will, play a role in determining Bitcoin and other cryptocurrency prices. [CaseBitcoin note: this is common bitcoin critique #6]

and:

When I a) put myself in the shoes of government officials, b) see their actions, and c) hear what they say, it is hard for me to imagine that they would allow Bitcoin (or gold) to be an obviously better choice than the money and credit that they are producing. [CaseBitcoin note: this is common bitcoin critique #2]

Dalio concludes his commentary by noting:

On the other hand, believe me when I tell you that I and my colleagues at Bridgewater are intently focusing on alternative storehold of wealth assets and expect Bridgewater to soon offer an alt-cash fund and a storehold of wealth fund in order to better deal with the devaluation of money and credit that we consider to be a major risk and opportunity, and Bitcoin won’t escape our scrutiny.

The letter goes on to provide an analysis of bitcoin's fundamental properties, benefits, risks, and market structure. Overall the piece provides a balanced assessment (though we would take issue with some of the commentary and analysis), and concludes by stating: 'Bitcoin, for now, feels more to us like an option on a potential storehold of wealth.'

tldr

Coindesk is reporting that Harvard, Yale, Brown, and some other colleges & universities, have been purchasing BTC for their endowments, possibly dating as far back as 2019. Coindesk quoted one of their two sources as saying:

It could be since mid-2019. Most have been in at least a year. I would think they will probably discuss it publicly at some point this year. I suspect they would be sitting on some pretty nice chunks of return.”

Yale's CIO, David Swenson, made headlines in 2018 by investing in 2 crypto funds, though those likely had large equity components at the time, and weren't bitcoin specific. The move was widely regarded as reducing career risk for other managers who may have sought to make similar moves. If Coindesk's sources are accurate, that appears to have paved the way for several CIOs to directly add BTC itself to their organizations' endowments.tldr

Marathon Patent Group - a Nasdaq-listed bitcoin mining company, announced that they converted a little under a third of their corporate treasury to BTC. The purchase totaled about $150 million.

As reported by The Block, Marathon CEO Merrick Okamoto explained:

By leveraging our cash on hand to invest in bitcoin now, we have transformed our potential to be a pure-play investment into a reality... We also believe that holding part of our treasury reserves in bitcoin will be a better long-term strategy than holding U.S. dollars, similar to other forward-thinking companies like MicroStrategy.

tldr

MicroStrategy CEO Michael Saylor announced the purchase of 314 BTC for $10.0mm this morning for their corporate treasury, bringing the company's total BTC holdings to ~70,784 BTC, worth about $2.3B (Jan 22 2021).

The SEC form 8k for the sale, dated Jan 22 2021, noted that the BTC was purchased at an average price of $31,808 suggesting MicroStrategy saw yesterday's BTC price drop (from ~$35,000 to briefly under $30,000) as an opportunity to add to their position.

tldr

Recent SEC filings from BlackRock (over $7T AUM) contain language suggesting they may participate in bitcoin futures markets, stating: "Certain Funds may engage in futures contracts based on bitcoin".

The Block further reports:

To be sure, the filings themselves don't definitively say that BlackRock funds are on the cusp of buying bitcoin futures, nor do they indicate whether BlackRock might buy futures that settle in cash or in actual bitcoin. But such filings have been known to predate these kinds of moves, indicating that BlackRock is at least laying down the regulatory tracks to conduct allocations if it so chooses.

tldr

Anthony Scaramucci, Founder of SkyBridge Capital, reiterated recent statements from NYDIG CEO Robert Gutmann noting that the high-dollar institutional interest in 'crypto' is exclusively limited to Bitcoin, in his experience. Mr Gutmann explained:

100 out of 100 of the last conversations I’ve had with investors seriously looking to allocate, let's say over 50 million dollars, 100% of those conversations have been about Bitcoin and 0% of them have been about any other crypto asset

Scaramucci added:

We [at] SkyBridge are also focused exclusively on #Bitcoin and feel it will be the big winner. FWIW most institutions we talk to have a similar view.

tldr

In any interview with Fox Business, Mayor of Miami, Francis Suarez, revealed his thinking in terms of attracting tech businesses, and specifically bitcoin and crypto businesses, to Miami:

We want to be one of the most crypto-forward and technological cities in the country. So we're looking at … creating a regulatory framework that makes us the easiest place in the United States to do business if you're doing it in cryptocurrencies.

Mayor Suarez also specifically noted the possibility of putting Bitcoin on the City of Miami's balance sheet, plus some of the reasons why it can be considered an attractive investment:

We're looking at the possibility of diversifying our investment portfolio and holding a percent of our investments in bitcoin.

The fact that it is limited, the fact that other governments use currencies to do a variety of things that have nothing to do necessarily with the exchange of goods, but to implement public policy, I think has made bitcoin a very attractive investment for many people.

tldr

Well known investor Howard Marks' latest investor letter indicates that he is at least somewhat warming up to bitcoin as a viable investment. In the past (2017, with BTC ~$2500), he has dismissed bitcoin as "not real", but his position now seems firmly neutral:

Thus, I've concluded (with Andrew's help) that I'm not yet informed enough to form a firm view on cryptocurrencies. In the spirit of open-mindedness, I'm striving to learn. Until I do, I'll be referring all requests for comments on the subject to Andrew (although I'm sure he'll decline).

The "Andrew" Howard refers to is his son, who is apparently much more on board with Bitcoin as a viable investment. Howard noted:

Back in 2017, my memo There They Go Again...Again included a section on cryptocurrencies in which I expressed a high level of skepticism. This view has been a source of much discussion for me and Andrew, who is quite positive on Bitcoin and several others and thankfully owns a meaningful amount for our family.

tldr

Switzerland's largest bank, UBS, announced today that they will begin charging clients with balances in excess of 250,000 Swiss francs (about $280,000) a 0.75% interest rate.

UBS explained why:

It’s becoming increasingly clear that we’ll have to contend with negative interest rates for years to come. That’s why we decided to lower the threshold for deposit fees,” Swiss banking head Axel Lehmann told employees in the memo.

tldr

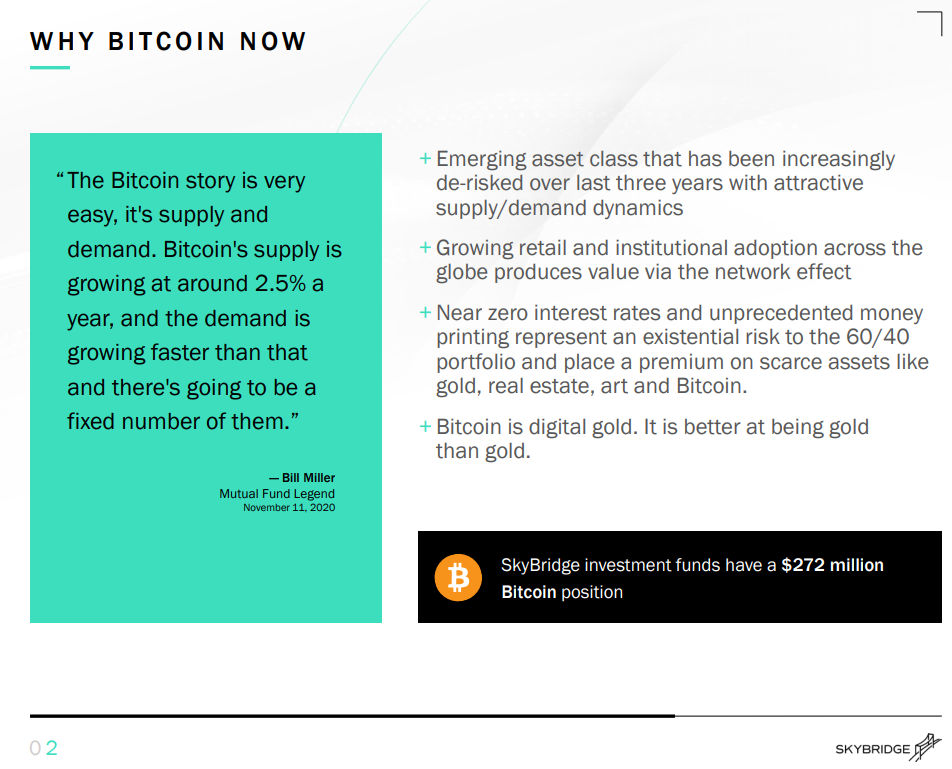

SkyBridge Capital released the investment deck for their new SkyBridge Bitcoin Fund. The deck walks through the investment case for bitcoin, covering everything from recent Wall St embrace of bitcoin, to bitcoin vs gold, the regulatory landscape, risks, and bitcoin as a monetary life raft.

The deck calls bitcoin "better at being gold than gold" and notes that BTC would have to trade at $535,000 if it reached market capitalization parity with gold.

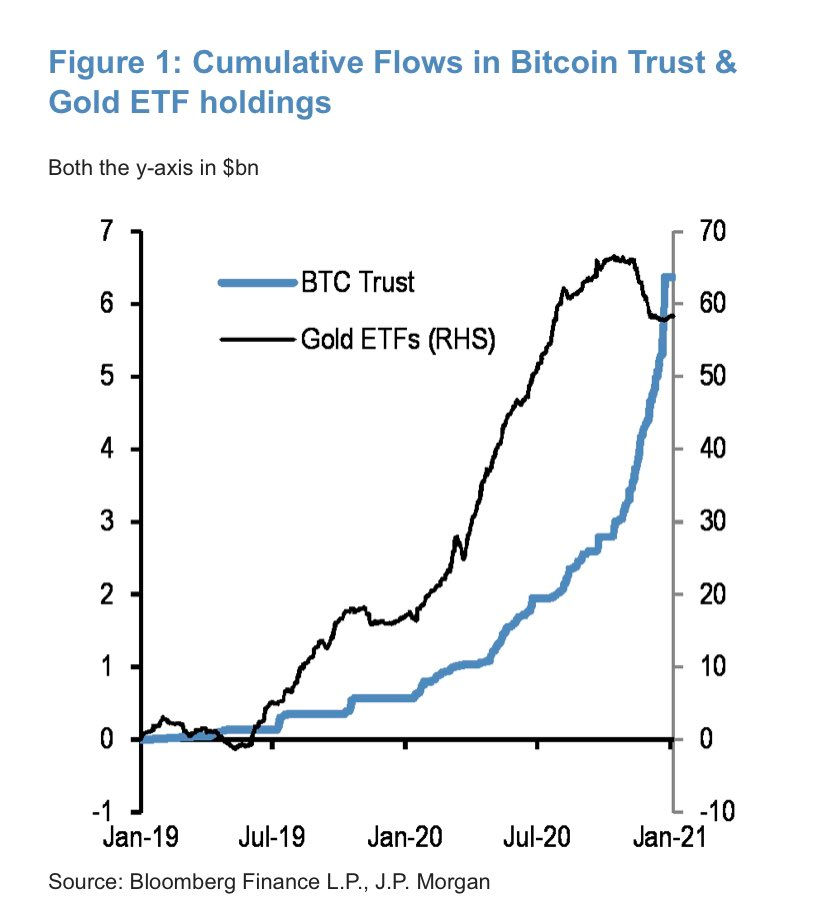

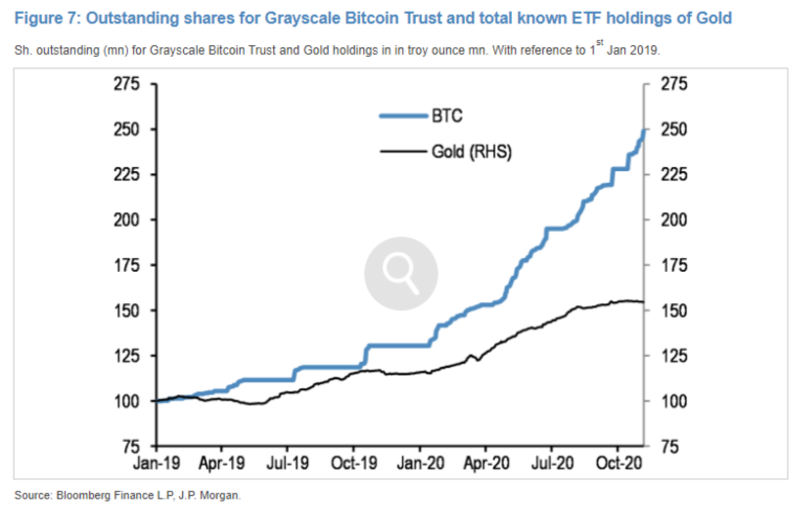

Holger Zschaepitz noted on twitter that outflows from gold ETFs since October have been over $7B, while inflows into GBTC, the Grayscale Bitcoin Trust, have been around $3B:

Zschaepitz further noted JP Morgan's take on the data:

Competition w/gold as alternative currency will continue given millennials will become over time more important.

tldr

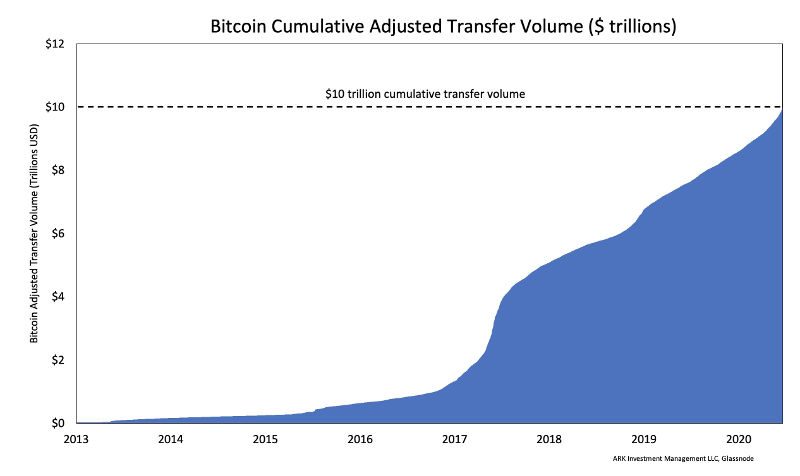

Yassine Elmandjra, cryptoasset analyst at ARK Invest, observed that bitcoin's total on-chain transaction volume is about to cross $10 trillion.

tldr

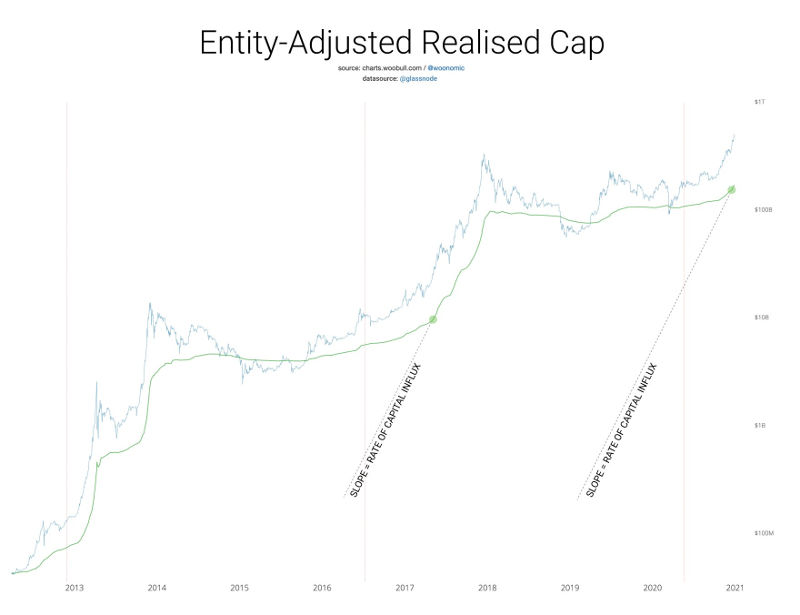

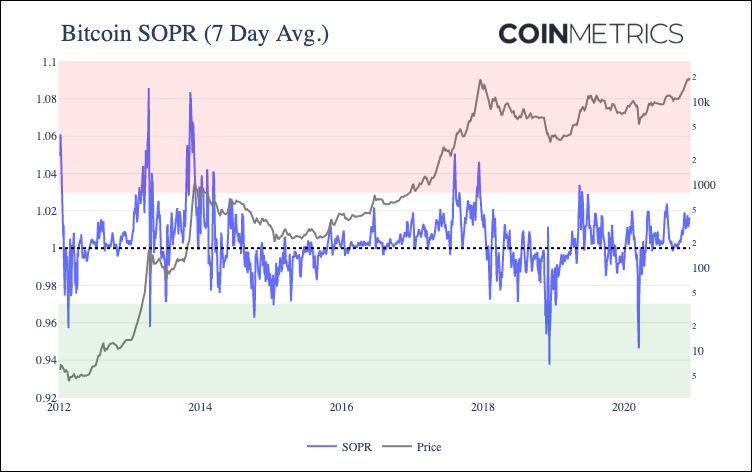

Bitcoin is up over 250% in 2020, and over 40% in the past month alone. It's natural to wonder if the bitcoin rally has more to go, or if it's reached a longer-term top. Thankfully, we can look at both onchain network data, as well as price data, and compare to prior bitcoin cycles.

Analyst Willy Woo has done just that, comparing the growth in realized cap (a proxy for aggregate entry price) that we see now vs the 2017 bull run. Willy finds that growth now is comparable to April 2017:

tldr

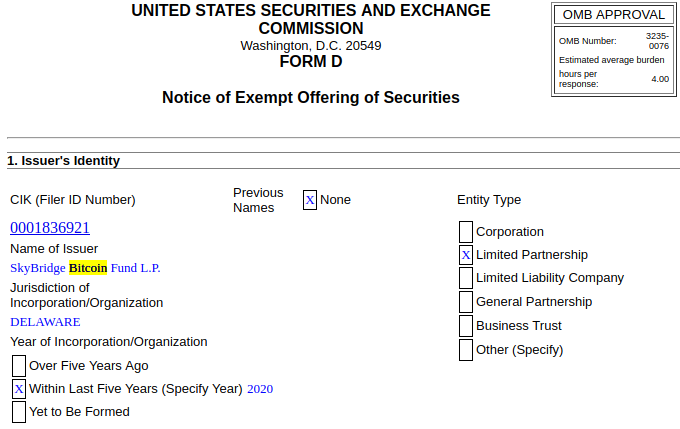

Anythony Scaramucci's SkyBridge Capital Filed with the SEC to create a subsidiary named 'SkyBridge Bitcoin Fund L.P.'. This follows previous news about SkyBridge showing interest in digital assets, but the fund name suggests more affinity for Bitcoin specifically.

tldr

Jefferies global head of equity strategy - Christopher Wood - reportedly trimmed his portfolio's gold holdings to make room for Bitcoin. He wrote:

The 50 per cent weight in physical gold bullion in the portfolio will be reduced for the first time in several years by five percentage points with the money invested in Bitcoin. If there is a big drawdown in bitcoin from the current level, after the historic breakout above the $20,000 level, the intention will be to add to this position

tldr

Coinbase - one of the most popular 'on ramps' for Bitcoin in the US - today announced that it has filed a draft form S-1 with the SEC, typically a precursor to an Initial Public Offering. A Coinbase IPO has been anticipated for some time.

With both bitcoin and US equity markets making all-time-highs, there could be significant excitement for Coinbase's IPO. As a recent example of exuberance for tech IPOs, AirBnB popped to more than double its IPO price on the first day of public trading last week.

tldr

Guggenheim's Scott Minerd stated on Bloomberg TV, while Fed Chair Jerome Powell was giving his FOMC meeting Q&A, that 'our fundamental work shows that bitcoin should be worth about 400,000 dollars'

When pressed regarding how Guggenheim arrived at that figure, he elaborated:

It's based on the scarcity and relative valuation to things like gold as a % of GDP. So bitcoin actually has a lot of the attributes of gold and at the same time has an unusual value in terms of transactions.

tldr

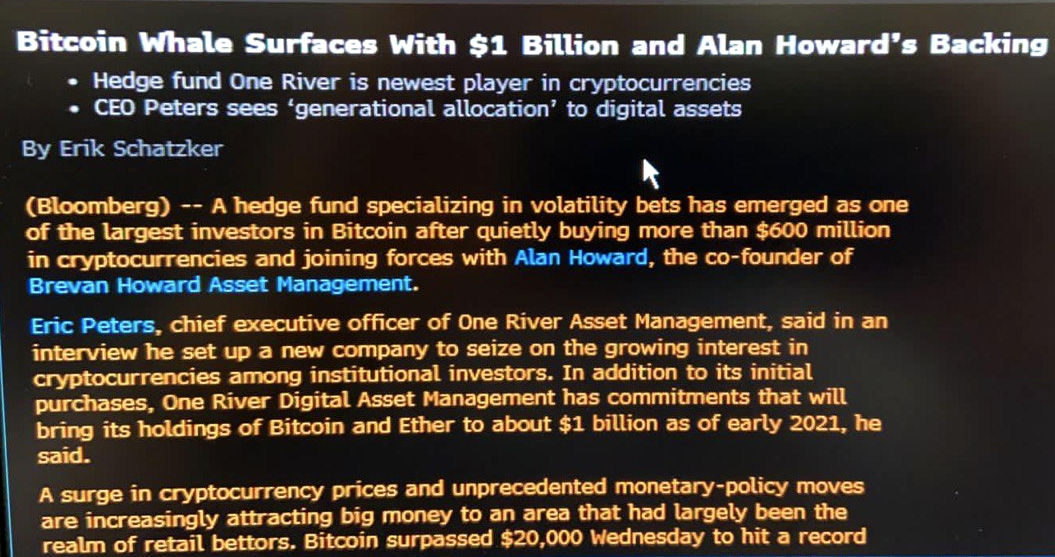

Bloomberg terminals are reporting a new fund created by One River Asset Management CEO Eric Peters, with support from Alan Howard, to 'seize on the growing interest in cryptocurrencies among institutional investors.'

$600mm in BTC and ETH have been purchased to date, with the total set to exceed $1B in early 2021

tldr

UK Investment Manager - Ruffer Investment Co - announced today that they have allocated 2.5% of their portfolio (£20B total AUM) to Bitcoin, calling it a 'small but potent insurance policy against the continuing devaluation of the world's major currencies.'

Additionally, they noted they made the BTC allocation in November, after 'reducing the company's exposure to gold.' Full text:

Performance Update & Manager Comment We wanted to give shareholders a short update on performance this year and to let you know about a new allocation to the digital currency bitcoin. The portfolio has made strong progress amid the turmoil of 2020. To the 8th December NAV point the NAV total return is 12.2%. During the panic back in March, the protective assets did all we hoped they would. In the spring and early summer, gold and the inflation-linked bonds performed well. More recently, the economically sensitive equities have reacted very positively to the success of the covid-19 vaccines, leading the portfolio higher. One recent addition, via one of the specialist managers appointed within the Ruffer Multi-Strategies Fund, has been bitcoin. This is primarily a defensive move, one made in November after reducing the company's exposure to gold. The exposure to bitcoin is currently equivalent to around 2.5% of the portfolio. We see this as a small but potent insurance policy against the continuing devaluation of the world's major currencies. Bitcoin diversifies the company's (much larger) investments in gold and inflation-linked bonds, and acts as a hedge to some of the monetary and market risks that we see.

tldr

According to Bloomberg, JPMorgan suggested in a note on Friday that MassMutual's $100mm investment in BTC for their general account significantly derisks BTC holdings in the eyes of other typically-conservative institutional money managers:

"MassMutual’s Bitcoin purchases represent another milestone in the Bitcoin adoption by institutional investors," the strategists said. "One can see the potential demand that could arise over the coming years as other insurance companies and pension funds follow MassMutual’s example."

If pension funds and insurance companies in the U.S., euro area, U.K. and Japan allocate 1% of assets to Bitcoin, that would result in additional Bitcoin demand of $600 billion, the strategists said.

tldr

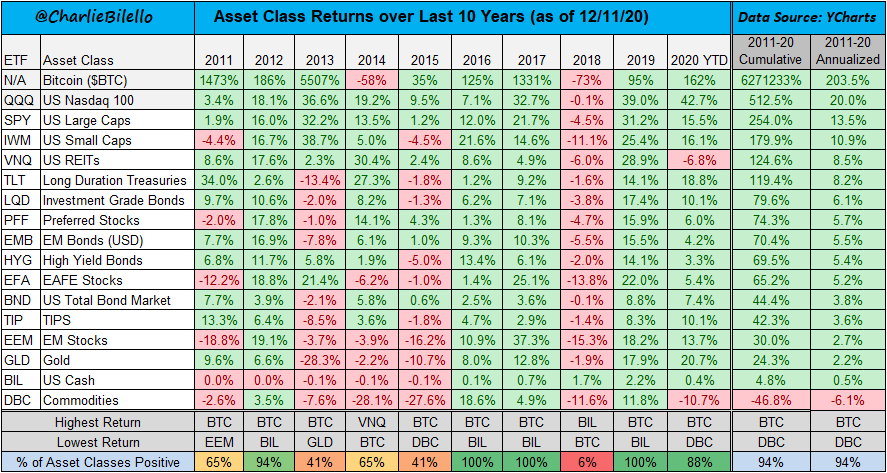

Charlie Bilello tweeted a matrix of asset-class returns, with Bitcoin returns dominating every other asset by orders of magnitude:

tldr

Bloomberg terminals are apparently reporting a Dow Jones Newswires story that Mass Mutual - an insurance firm founded in 1851 - has invested $100mm in Bitcoin:

UPDATE: Wall Street Journal coverage: MassMutual Joins the Bitcoin Club With $100 Million Purchase

tldr

In partnership with Blockfi, a leading provider of bitcoin-backed loans and related services, Fidelity Digital Assets will allow institutional customers to use Bitcoin as collateral for cash loans.

tldr

MicroStrategy is upsizing their prior $400mm convertible debt-offering, which is earmarked for BTC purchases, by $150mm-$250mm. The offering is now $550mm, with an additional $100mm follow-on option, and is expected to close private-placement Dec 11th. The notes mature in 2025, and may be converted to equity (at a 37.5% premium to current $MSTR price) at the company's election.

tldr

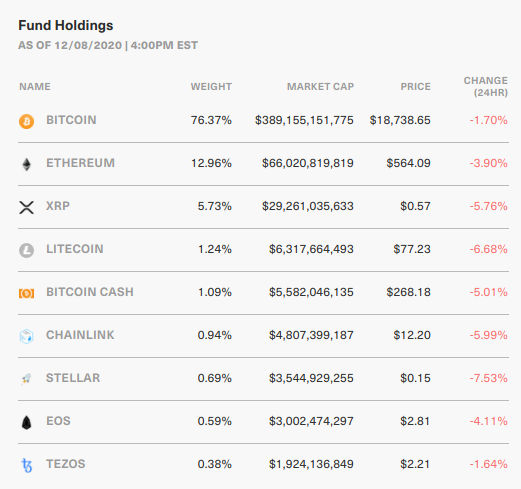

Bitwise Investments launched a public-traded crypto index fund, under the ticker $BITW, composed of the top-10 crypto-assets. The index is market-cap weighted, and is currently over 76% Bitcoin.

tldr

CoinMetrics' latest newsletter explores and explains various on-chain metrics that can be used to gauge bitcoin's fundamentals.

As a timely example of how to use these metrics, Glassnode CTO Rafael Schultze-Kraft tweeted a thread looking at various on-chain metrics for bitcoin, and where they sit currently compared to the peak of bitcoin's 2017 run from ~$1000 to ~$20,000.

tldr

MicroStrategy - having already purchased close to $500mm in BTC (which has since appreciated substantially) - announced today that it plans to issue $400mm in senior unsecured convertible notes, and use the proceeds to buy more bitcoin:

The notes will be unsecured, senior obligations of MicroStrategy and will bear interest payable semi-annually in arrears on June 15 and December 15 of each year, beginning on June 15, 2021. The notes will mature on December 15, 2025 MicroStrategy intends to invest the net proceeds from the sale of the notes in bitcoin in accordance with its Treasury Reserve Policy pending the identification of working capital needs and other general corporate purposes.

tldr

Bloomberg reports that the Bank of Japan is now the largest holder of Japanese equities, with over $400B in holdings:

tldr

After moderating a webinar on 'The State of Crypto Prime Brokerage', Frank Chaparro notes:

Bold prediction by Michael Moro, CEO of GenesisTrading, one of the largest crypto trading firms: Based on the activity he is seeing, he predicts 250 publicly traded companies will allocate a portion of their balance sheet to Bitcoin in the next year.

tldr

Larry Fink, CEO of Blackrock - the world's largest asset manager, with over $7 trillion under management - updated his stance on Bitcoin yesterday, now acknowledging its potential global relevance. In a conversation with Bank of England governor Mark Carney, he said: "Can it evolve into a global market? Possibly." Forbes reports:

Fink, who was answering questions alongside former Bank of England governor Mark Carney, said the level of attention generated by previous BlackRock comments on bitcoin showed how the cryptocurrency has "caught the attention and the imagination of many" who are "fascinated and excited by it." "Can [bitcoin] evolve into a global market," Fink asked. "Possibly. [Bitcoin is] still untested, a pretty small market relative to other markets. You see these big giant moves every day. It’s a thin market."

tldr

AllianceBernstein (~$600B AUM) co-head of portfolio strategy, Inigo Fraser Jenkins, suggests Bitcoin has a role to play in investor portfolios. Coindesk reports:

... post-pandemic changes to the policy environment, debt levels and diversification options for investors mean the asset manger now has “to admit [bitcoin] does” have a role in asset allocation, at least over the long term. Fraser Jenkins said the “significant reduction” in the volatility of bitcoin’s price makes it more attractive both as a store of value and as a medium of exchange.

tldr

Author of The Ascent of Money and Stanford Fellow, Niall Ferguson, authored a Bloomberg Opinion piece today in which he argues Bitcoin is "scarce, sovereign and a great place for the rich to store their wealth." He elaborates:

What is happening is that Bitcoin is gradually being adopted not so much as means of payment but as a store of value. Not only high-net-worth individuals but also tech companies are investing. In July, Michael Saylor, the billionaire founder of MicroStrategy, directed his company to hold part of its cash reserves in alternative assets. By September, MicroStrategy’s corporate treasury had purchased bitcoins worth $425 million. Square, the San Francisco-based payments company, bought bitcoins worth $50 million last month. PayPal just announced that American users can buy, hold and sell bitcoins in their PayPal wallets.

tldr

Guggenheim Funds - managing a total $233B - filed an amendment with the SEC to allow their subsidiary Guggenheim Macro Opportunities Fund, with ~$5B under management, to be able to invest up to 10% of the fund into GBTC.

GBTC is a publicly traded vehicle representing shares of the Grayscale Bitcoin Trust which invests solely in Bitcoin. Given the failure of the SEC to approve a Bitcoin ETF, GBTC has become the de-facto Bitcoin ETF-like product for US markets. It almost always trades at a substantial premium to net-asset-value due to various details of the fund's underlying operating rules.

tldr

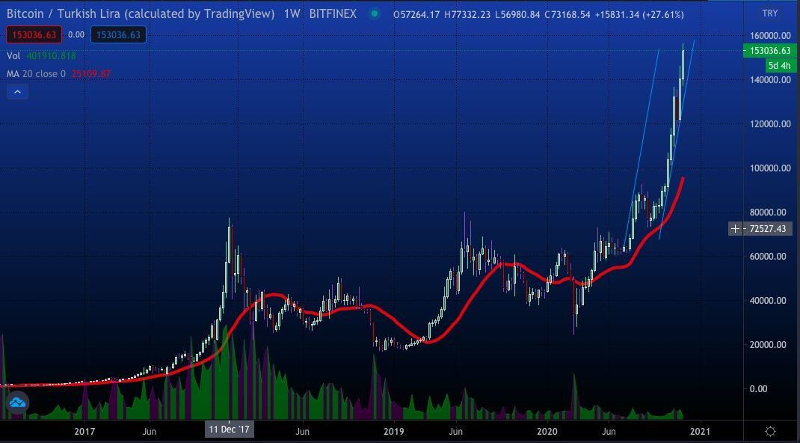

Cory Klippsten, CEO of Swan Bitcoin, observes that Bitcoin is currently trading at double its 2017 all-time-high when priced in Turkish Lira:

tldr

Biden unveiled Janet Yellen as his pick for Treasury Secretary, yesterday, suggesting a tight working relationship between treasury and Jerome Powell's Fed. Powell's recent re-orienting of the Fed towards tolerating higher inflation and focusing more on employment goals dovetails well with some of Yellen's recent comments:

“While the pandemic is still seriously affecting the economy we need to continue extraordinary fiscal support, but even beyond that I think it will be necessary,” Yellen said Oct. 19 on Bloomberg Television. “We can afford to have more debt,” she added, because interest rates will probably be low “for many years to come.”

tldr

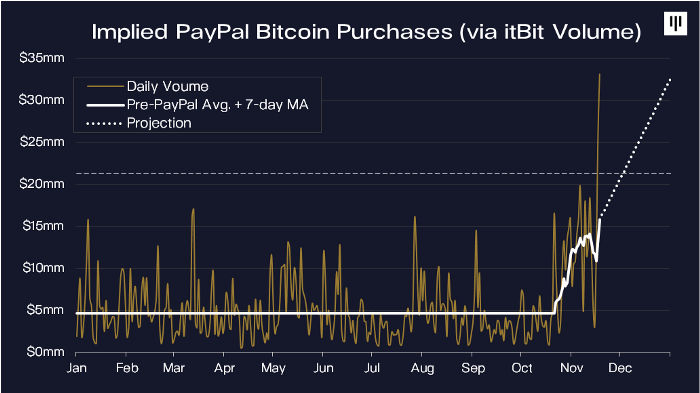

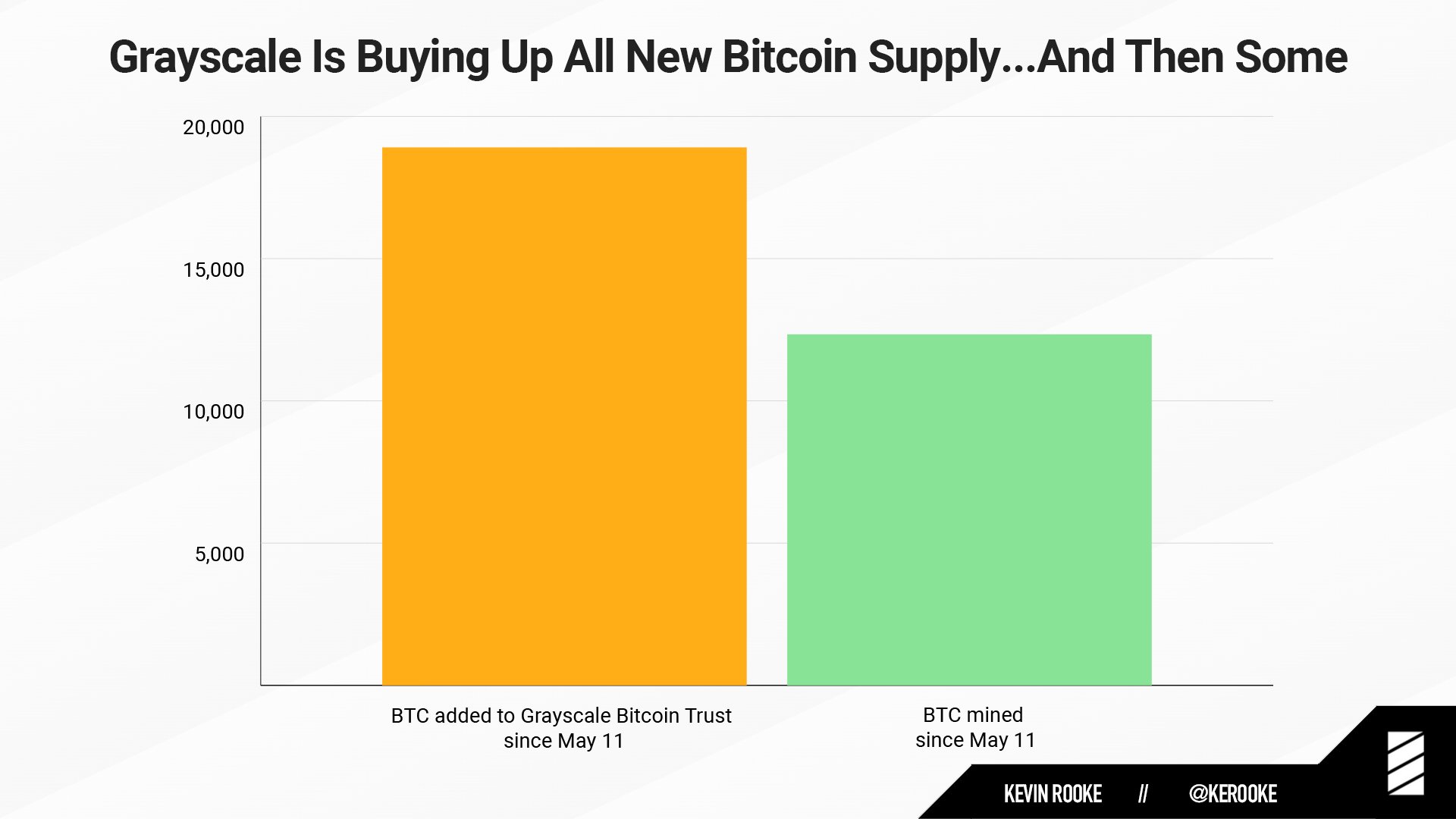

In Pantera's November 2020 Blockchain Letter, titled Bitcoin Shortage, they observe that bitcoin volumes on Paxos, the underlying crypto partner for PayPal, have gone through the roof since PayPal enabled crypto purchases on Nov 12th:

Pantera goes on to note that it looks like PayPal alone - after just one week of operation - is "buying almost 70% of the new supply of bitcoins".

tldr

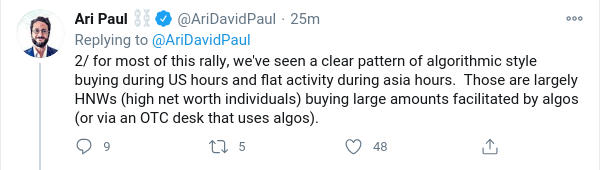

CIO of Blocktower Capital, Ari Paul, tweeted today shedding some light on where the bitcoin buying pressure has come from that's pushed BTC from $10,000 over the summer, to over $18,000 today. In short: HNWs. Ari explains:

tldr

Anthony Pompliano ("Pomp") tweeted video of a CNBC interview this morning with BlackRock CIO of Global Fixed Income & Head of Global Allocation, Rick Rieder. Mr Rieder compared Bitcoin to gold, saying:

Do I think [bitcoin] is a durable mechanism that will take the place of gold to a large extent? Yeah I do...

Additionally, Mr Rieder took specific note of millennials' acceptance of digital money systems generally in making the case that bitcoin is here to stay and is something to pay attention to.

tldr

Liz Ann Sonders tweeted a chart from Bianco Research showing that the US Federal Reserve now holds more US Treasury bonds than all other central banks combined:

tldr

Mexican billionaire Ricardo Salinas Pliego (net worth: $13.2B) disclosed via twitter that 10% of his "liquid portfolio" is currently invested in bitcoin:

tldr

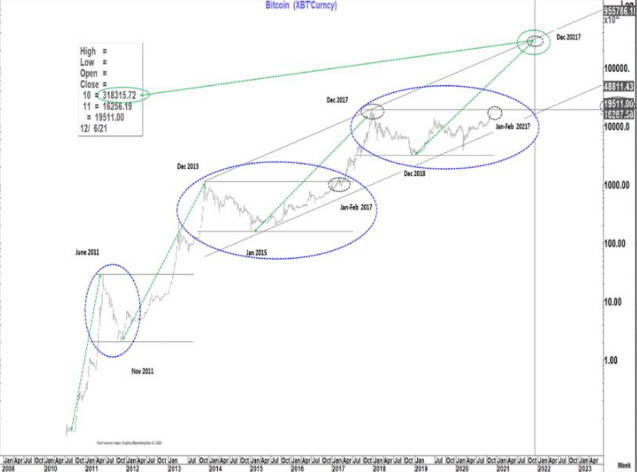

A report by Citibank Managing Director Tom Fitzpatrick surfaced over the weekend, drawing strong fundamental analogies between bitcoin today, and the gold market of the 1970s. The report cites recent macro-economic events as analogous to closing the gold window in the early 1970s, and Bitcoin as "21st century gold", experiencing rapid monetization and financialization in response to structural macro changes.

Fitzpatrick goes on to analyze bitcoin's price cycles, and arrives at perhaps the largest medium term institutional price target we've seen for BTC: $318,000 by the end of 2021:

tldr

Incoming US Senator from Wyoming, Cynthia Lummis, discusses how she wants to make bitcoin "part of the national conversation", how she thinks bitcoin "fits the bill" as a store of value, and comments on bitcoin's finite supply as a key factor in her belief that bitcoin will be "an important player in stores of value for a long time to come."

tldr

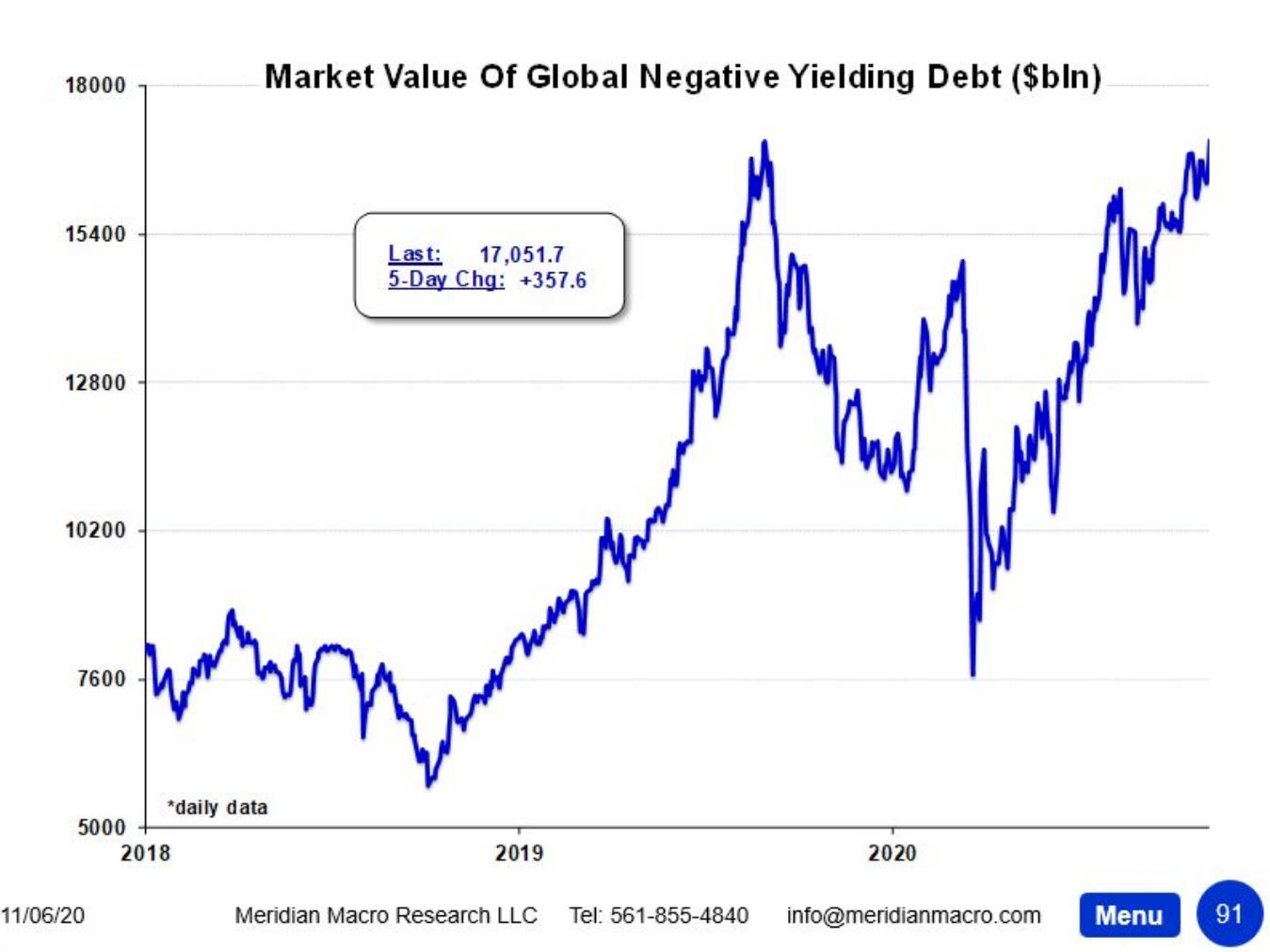

Eric Pomboy of Meridian Macro Research pointed out last week that there's now $17.05 trillion in negative yielding debt globally, a new high:

tldr

In a recent report on the Grayscale Bitcoin Trust, JPMorgan took a look at flows into BTC products vs Gold ETFs, and concluded:

What makes the October flow trajectory for the Grayscale Bitcoin Trust even more impressive is its contrast with the equivalent flow trajectory for gold ETFs, which overall saw modest outflows since mid-October. This contrast lends support to the idea that some investors that previously invested in gold ETFs such as family offices, may be looking at Bitcoin as an alternative to gold.

tldr

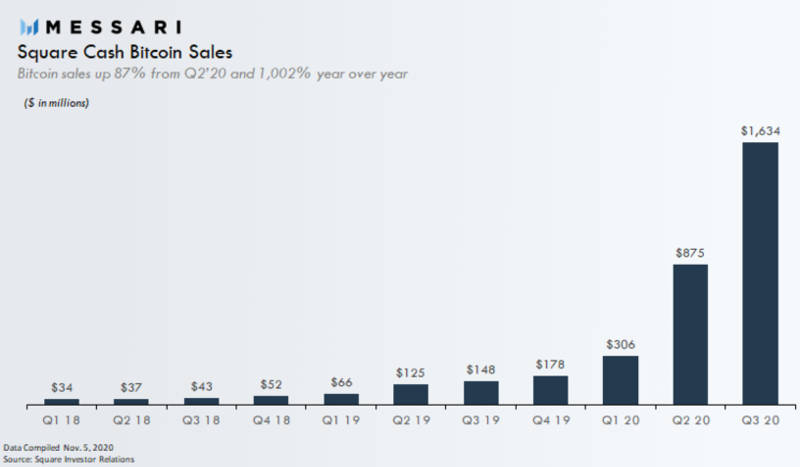

Ryan Watkins of Messari reports that Square Cash bitcoin purchases in Q3 nearly doubled the then-record-setting Q2:

tldr

Luke effectively points out that the US government has no choice, no matter which party is in office. The dollar must be debased to keep the economy functioning.

tldr

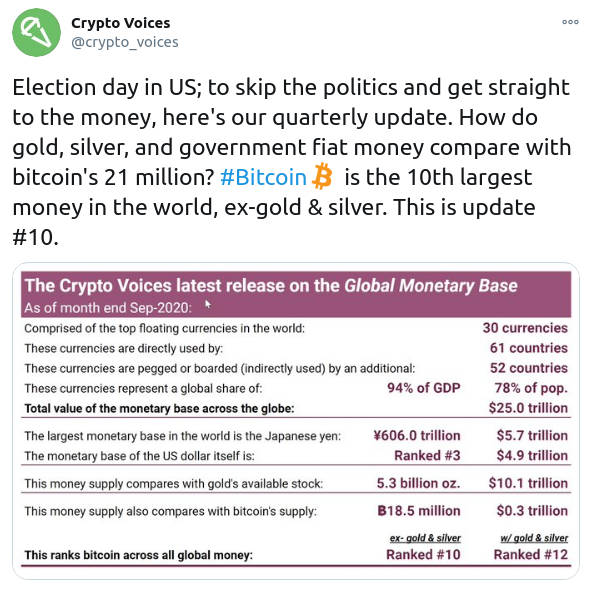

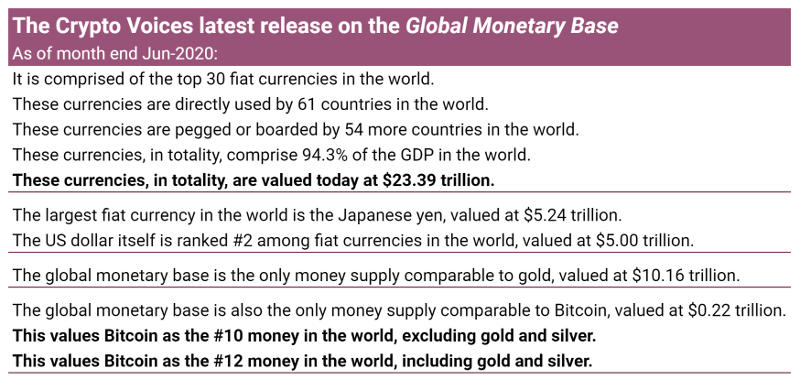

Crypto Voices Update #10 is out, documenting bitcoin's progress as a global monetary asset. Now #10 in terms of monetary base, outside of gold and silver:

tldr

Dan Tapiero comments on the longer-term effects of Jerome Powell's pandemic response, noting the unprecedented rise in US M2 and ramifications for US treasuries as a a good investment vehicle.

tldr

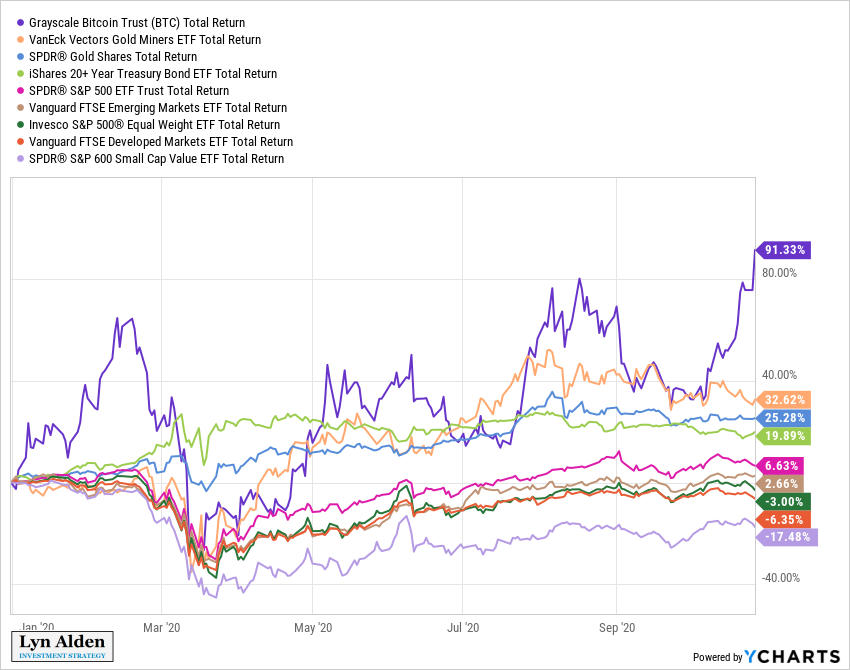

Lyn Alden compares year-to-date performance of various asset classes, showing Bitcoin's clear out-performance:

tldr

As Paul Tudor Jones noted in his May 2020 Macro Outlook Letter regarding Bitcoin vs other potential inflation hedges: "At the end of the day, the best profit-maximizing strategy is to own the fastest horse". Check out our dynamic multi-asset ROI chart here.

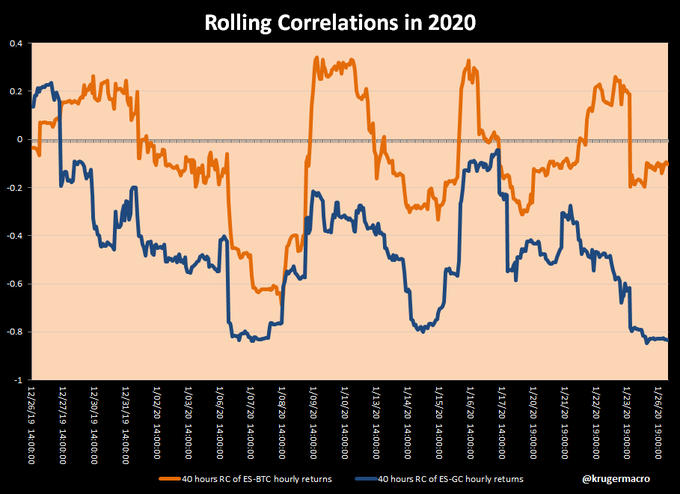

Bitcoin and gold were very correlated during Fed Chair Powell's "Jackson Hole" speech earlier today. They both "faded the fed" fairly quickly, but the correlation is significant and undeniable nonetheless.

tldr

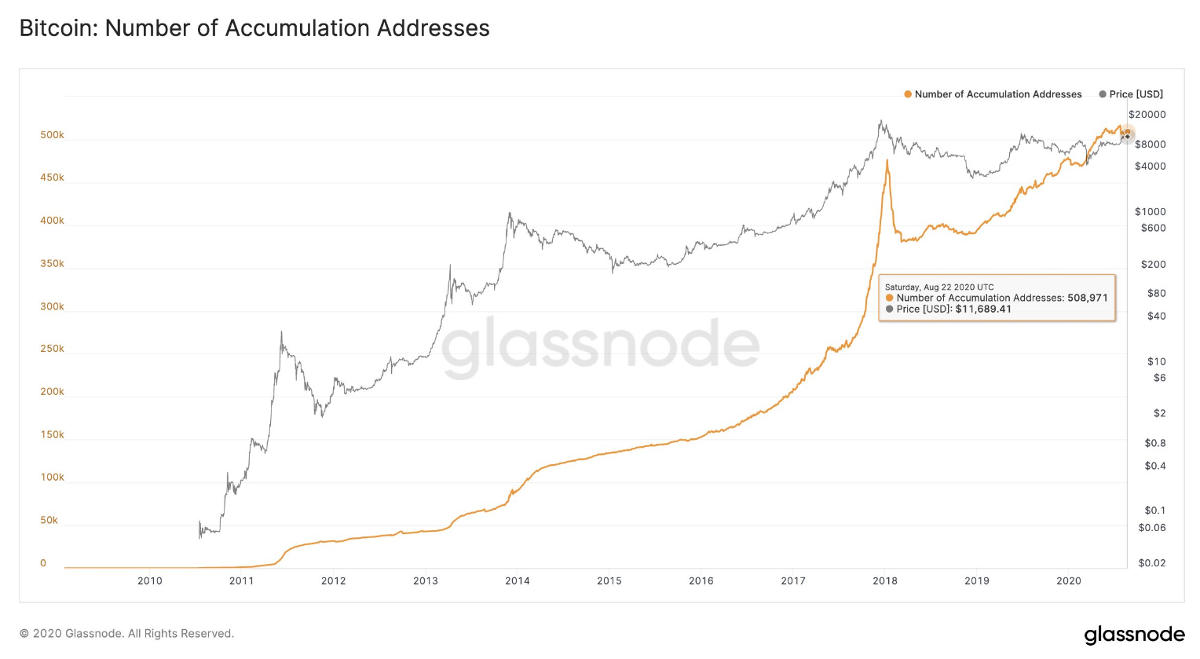

Glassnode has an interesting 'accumulation address' metric defined, which tries to quantify store-of-value behavior. Such behavior is hitting all-time-highs:

tldr

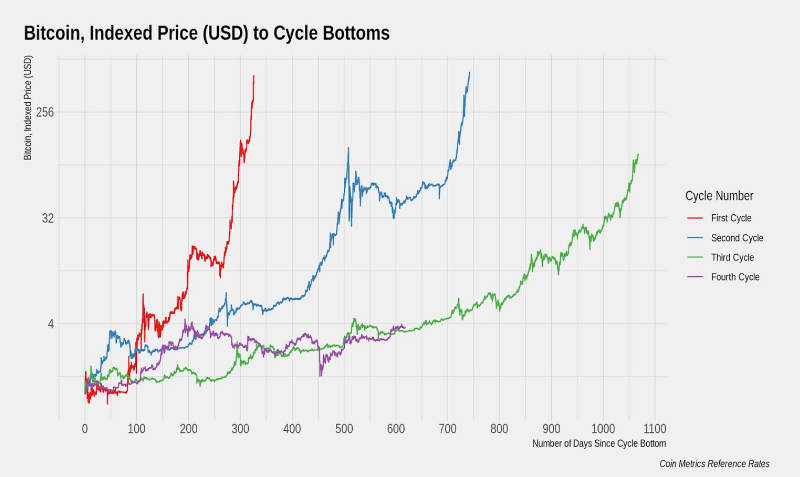

Research and data firm Coinmetrics charts each of Bitcoin's major market cycles, from bull market start to the eventual top. If history is any guide, the duration of bitcoin's cycles are extending:

tldr

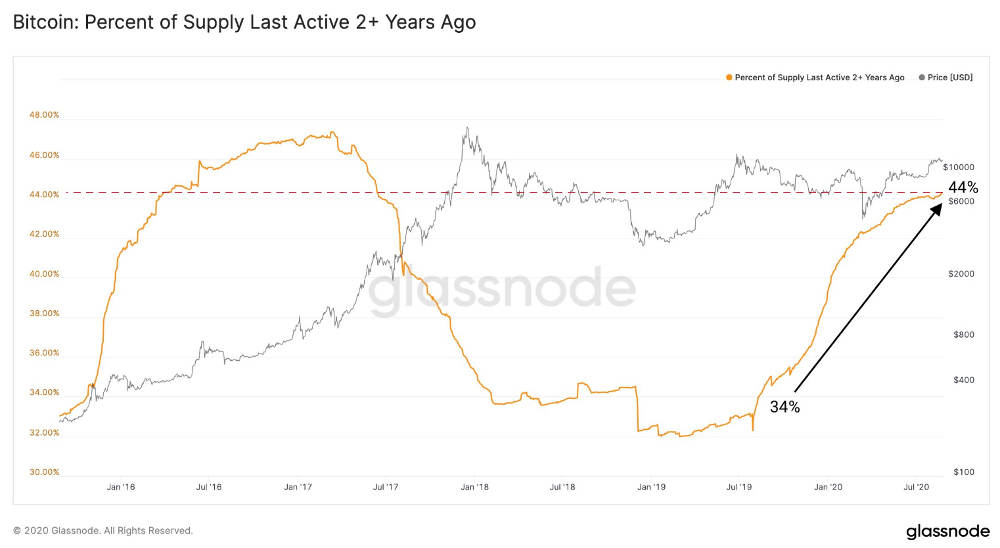

Glassnode highlights a 3yr high in the % of BTC supply that hasn't moved in 2yrs:

tldr

Last week we covered public-traded company MicroStrategy's decision to put $250mm of their corporate treasury into Bitcoin as a prudent move to hedge inflation. Today, we see another annoucement to this effect by online graphics company Snappa. CEO Christopher Gimmer explains the reasoning behind the move:

After pouring over the research myself, I believe that massive amounts of quantitative easing combined with fiscal stimulus will continue to result in currency debasement. In addition, I expect governments to keep doing more of the same in attempts to fight the natural deflationary pressures of technology. In order to hedge this risk, we’ve chosen to adopt Bitcoin as a primary reserve asset on our balance sheet.

tldr

More companies are viewing BTC as a prudent diversification strategy for treasury holdings as macro-concerns regarding fiat sustainability intensify. This trend can be thought of as analogous to companies that operate internationally hedging currency risk by holding various other currencies. More companies are simply realizing they are exposed to *fiat* risk no matter where they operate, and are starting to see BTC as an appropriate hedge.

Additionally, Mr. Gimmer referenced a number of key pieces we catelog in the CaseBitcoin Library:

Crypto Voices Q2 "Global Monetary Base" report puts bitcoin as the #10 money in the world, excluding gold and silver.

This report - released via tweet storm - takes detailed stock of the landscape of money globally, from fiat M1/M2/M3 discussion, to gold and silver, to bitcoin, and trends between them.

tldr

Lyn Alden notes on twitter:

YTD through June, over $3T in net Treasury issuance occurred for stimulus, and foreigners only bought $194B. So, the percent of US federal debt held by the foreign sector has dropped to the lowest percentage in over a decade, and the biggest buyer during this year was the Fed.

tldr

Today is the 49th anniversary of when President Richard Nixon severed the final ties between the dollar and gold. The US had been creating and spending more dollars than it had gold reserves for decades, and markets were forcing the US to finally admit it, lest USD holders convert too much to gold thereby draining US gold reserves completely.

tldr

Publicly traded company business intelligence company MicroStrategy ($MSTR) disclosed today that they acquired 21,545 BTC (~$250m) as part of capital allocation strategy for their corporate treasury.

They cited the following key reasons for the allocation:

This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash. ... MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.”

“We find the global acceptance, brand recognition, ecosystem vitality, network dominance, architectural resilience, technical utility, and community ethos of Bitcoin to be persuasive evidence of its superiority as an asset class for those seeking a long-term store of value. Bitcoin is digital gold – harder, stronger, faster, and smarter than any money that has preceded it.

tldr

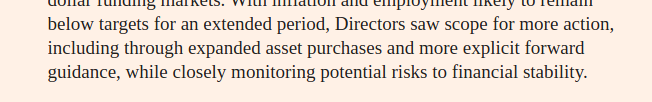

The IMF Executive Board concluded a consultation with the United States, during which they suggest that the US Federal Reserve has room for more asset purchases:

tldr