Bitcoin Marketcap

$1.24T

Gold Marketcap

$32.05T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

Bitcoin Marketcap

$1.24T

Gold Marketcap

$32.05T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

Fidelity, Citi, and Goldman Sachs all made bitcoin headlines today, with Fidelity and Citi releasing extensive (and positive) reports on bitcoin, and Goldman Sachs announcing the restart of their bitcoin trading desk.

Fidelity's Director of Global Macro, Jurrien Timmer, tweeted that bitcoin "could be treated as a form of digital gold…a possible counterweight to future monetary inflation:"

Mr Timmer also linked to a paper of his hosted on Fidelity Institutional, which suggests that bitcoin may be an appropriate replacement for some part "of the bond side of a 60/40 portfolio."

Next, Citi GPS released a 108 page report titled "Bitcoin At the Tipping Point". The report's intro notes:

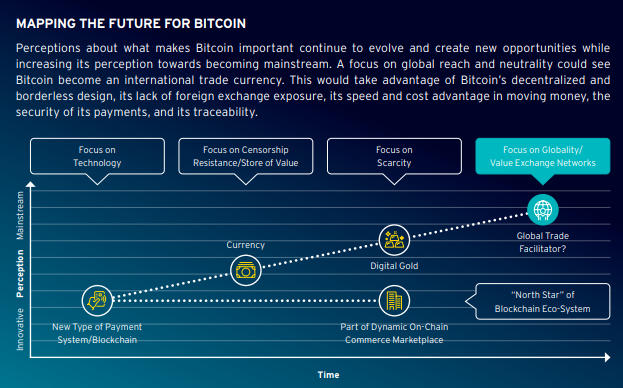

In a search for yield and alternative assets, investors are drawn to Bitcoin's inflation hedging properties and it is recognized as a source of 'digital gold' due to its finite supply. ... Where could Bitcoin be in another seven or so years? The report notes the advantage of Bitcoin in global payments, including its decentralized design, lack of foreign exchange exposure, fast (and potentially cheaper) money movements, secure payment channels, and traceability. These attributes combined with Bitcoin's global reach and neutrality could spur it to become the currency of choice for international trade.

Finally, Reuters is reporting that Goldman Sachs has restarted their cryptocurrency trading desk, beginning with various bitcoin instruments. Reuters notes the bank is also exploring related bitcoin services:

the bank is also exploring the potential for a bitcoin exchange traded fund and has issued a request for information to explore digital asset custody, the source said.

tldr