Bitcoin Marketcap

$1.27T

Gold Marketcap

$31.04T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

Bitcoin Marketcap

$1.27T

Gold Marketcap

$31.04T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

20 May 2020 | | Price when published: $9,647 (ROI since: +598%)

Filed under: fundamentals

reports

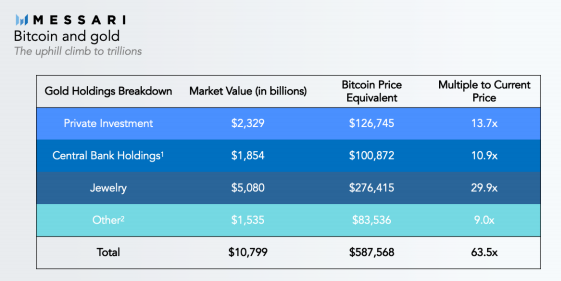

Messari takes a macro-oriented and data-driven approach to making a very strong investment case for Bitcoin, culminating in a comparison to gold which suggests a 6300% upside potential:

The core thesis is build around the observations that:

Finally there’s just simply more upside in Bitcoin than more established store of

value assets like gold. There are many people, usually unacquainted with Bitcoin,

who suggest that Bitcoin is overvalued based on its $170 billion market

capitalization. This usually stems from misguided comparisons to company

valuations or criticisms of Bitcoin’s lack of intrinsic value. It’s important to

understand Bitcoin is not a company. It is a money. Not only are monies valued in

the trillions of dollars, but they also have very little if any intrinsic value. The total

value of above-ground gold, which has limited industrial use, is more than $10

trillion. The total value of all the base fiat money in the world, which only has value

because governments say they do, is worth nearly $20 trillion dollars.

What do you think of this piece?