Bitcoin Marketcap

$1.33T

Gold Marketcap

$30.87T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

Bitcoin Marketcap

$1.33T

Gold Marketcap

$30.87T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

10 Jan 2014 | | Price when published: $839.14 (ROI since: +8,278%)

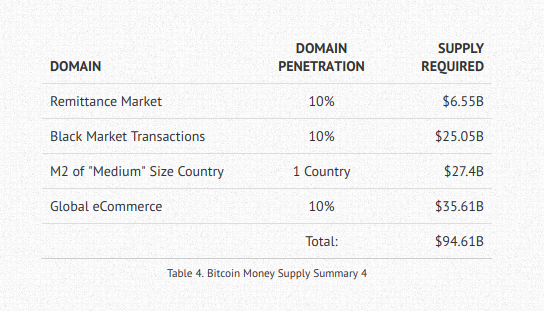

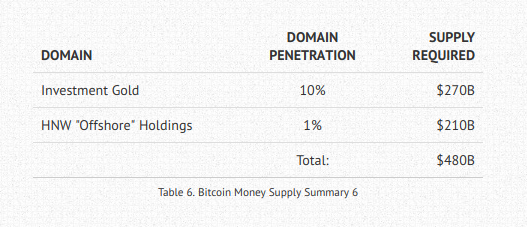

This is one of the earliest pieces attempting to quantitatively value bitcoin based on its key properties: medium of exchange, and store of value. Using this framework, the piece arrives at a fair-value of $27,381 "in order to support 10% of common medium-of-exchange economic activity, plus well under 10% of existing common store-of-value demand".

What do you think of this piece?