Bitcoin Marketcap

$1.26T

Gold Marketcap

$32.05T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

Bitcoin Marketcap

$1.26T

Gold Marketcap

$32.05T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

12 Nov 2017 | | Price when published: $6,084 (ROI since: +994%)

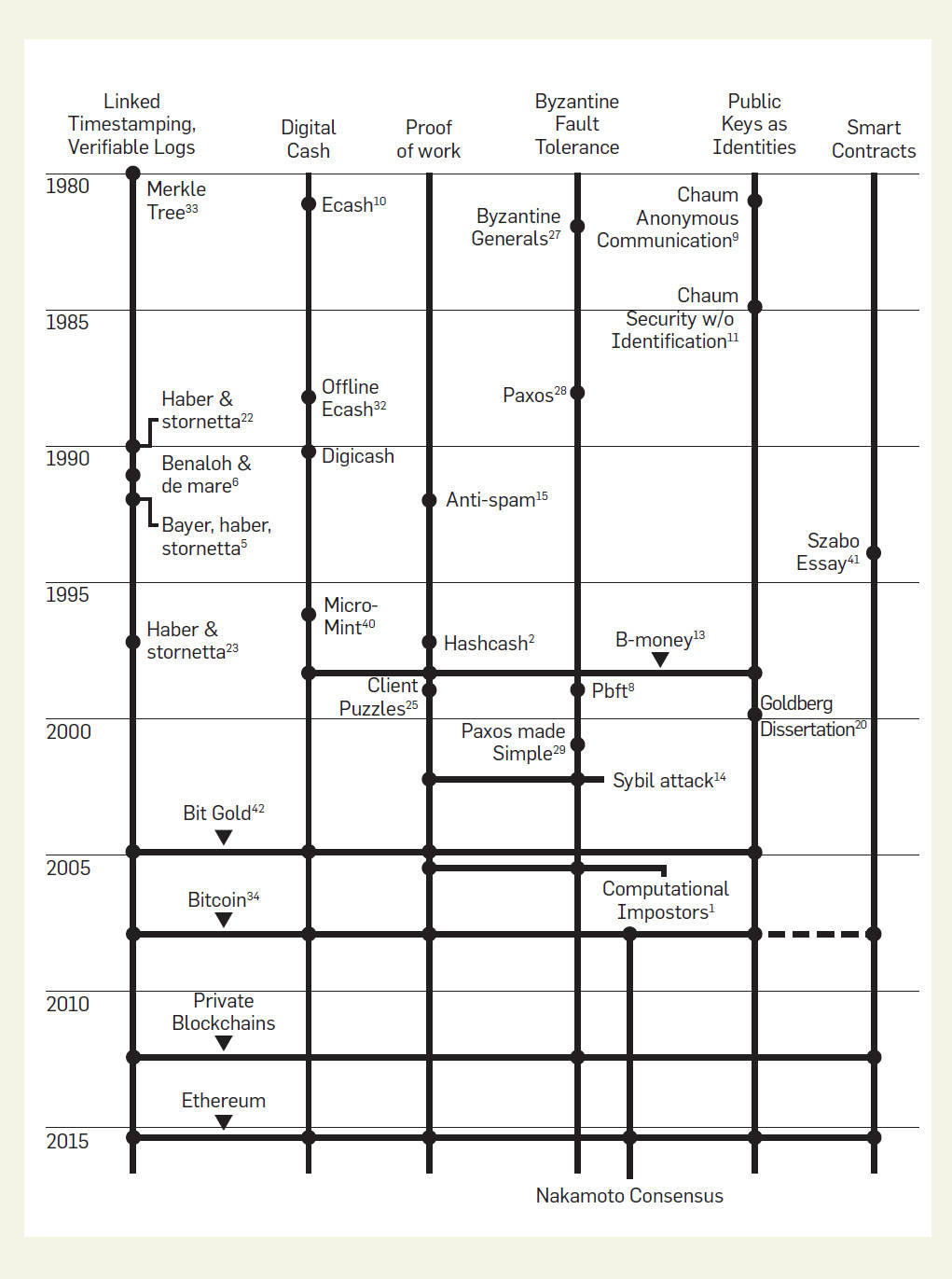

The bitcoin white paper, despite the pedigree of many of its ideas, was more novel than most academic research. Moreover, Nakamoto did not care for academic peer review and did not fully connect it to its history. As a result, academics essentially ignored bitcoin for several years. Many academic communities informally argued that Bitcoin could not work, based on theoretical models or experiences with past systems, despite the fact it was working in practice.

We have seen repeatedly that ideas in the research literature can be gradually forgotten or lie unappreciated, especially if they are ahead of their time, even in popular areas of research. Both practitioners and academics would do well to revisit old ideas to glean insights for present systems. Bitcoin was unusual and successful not because it was on the cutting edge of research on any of its components, but because it combined old ideas from many previously unrelated fields.

...

What do you think of this piece?