Bitcoin Marketcap

$1.28T

Gold Marketcap

$31.03T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

Bitcoin Marketcap

$1.28T

Gold Marketcap

$31.03T

BTC Settlement Volume (24hr)

$12.90B

BTC Inflation Rate (next 1yr)

1.17%

CASEBITCOIN

making the case for bitcoin every day

CASEBITCOIN

making the case for bitcoin every day

28 Feb 2018 | | Price when published: $10,449 (ROI since: +547%)

Filed under: investment

videos

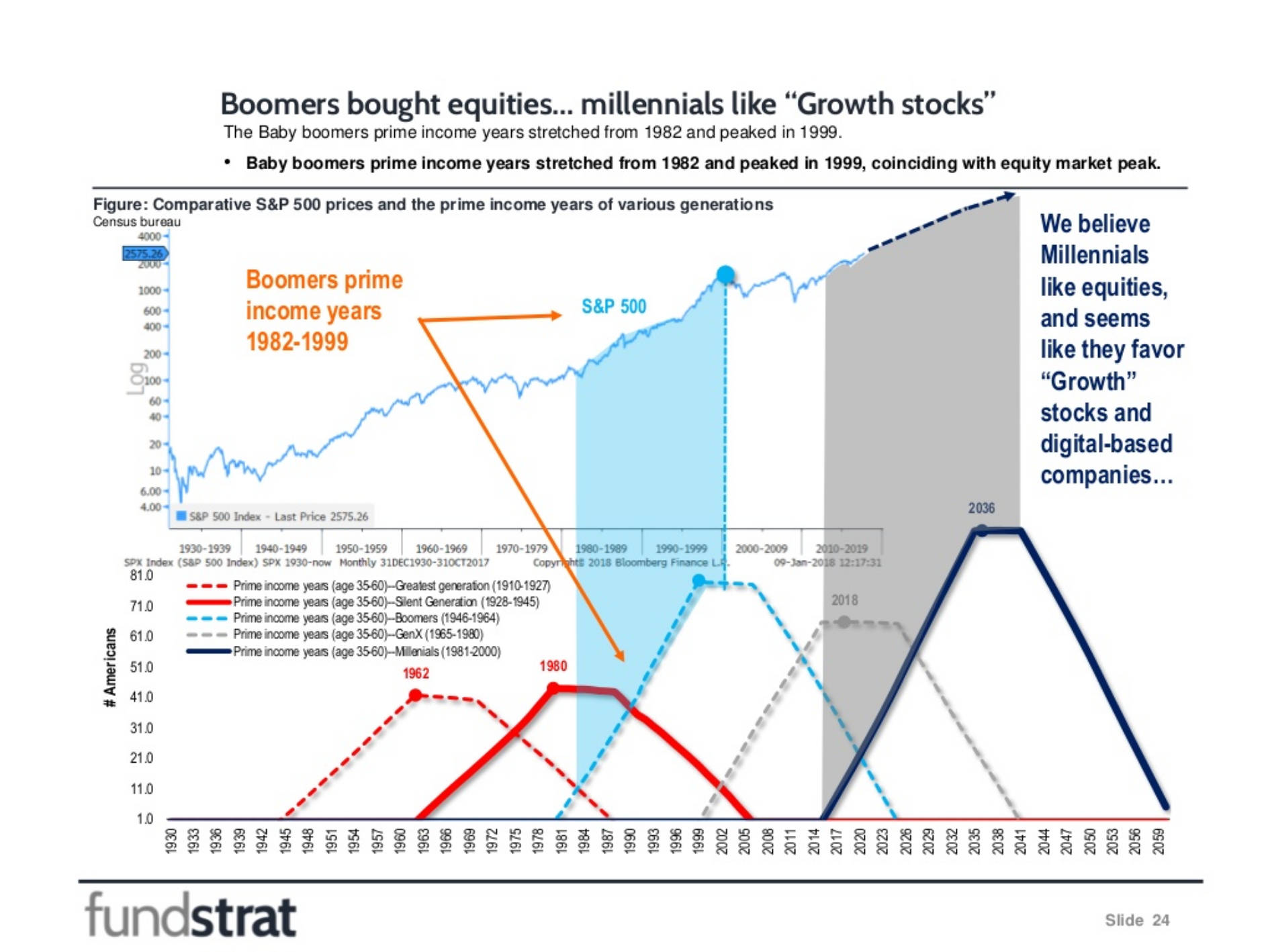

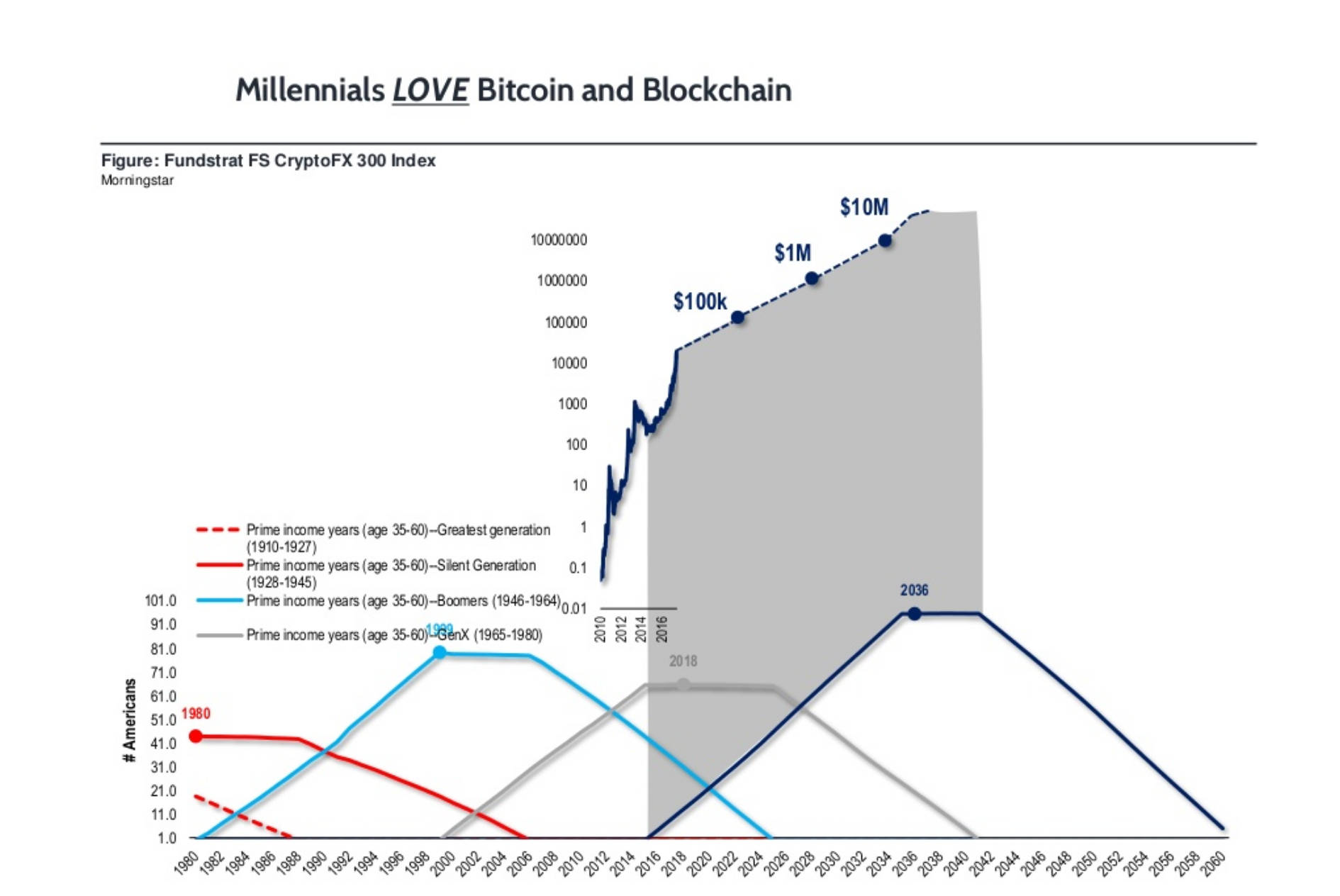

Tom outlines broad generational trends, and how markets peak with the peak-earnings power of generational cohorts. He further maps asset class performance to these peaks, and asserts that if prior trends hold, millennials may drive a large peak in crypto-assets, implying a top for bitcoin of $10million/BTC in the mid 2030s.

What do you think of this piece?